Managing an equity plan is no easy feat.

It demands expertise, precision, and constant vigilance. That's where Infinite Equity comes in, we offer an outsourcing solution that is a strategic advantage for companies of all sizes.

Dedicated Partners

Working hand-in-hand with you to provide the equity expertise you need.

Results Oriented

Going above and beyond to help your company succeed.

Proven Experts

Get guidance from the industry’s most recognized experts.

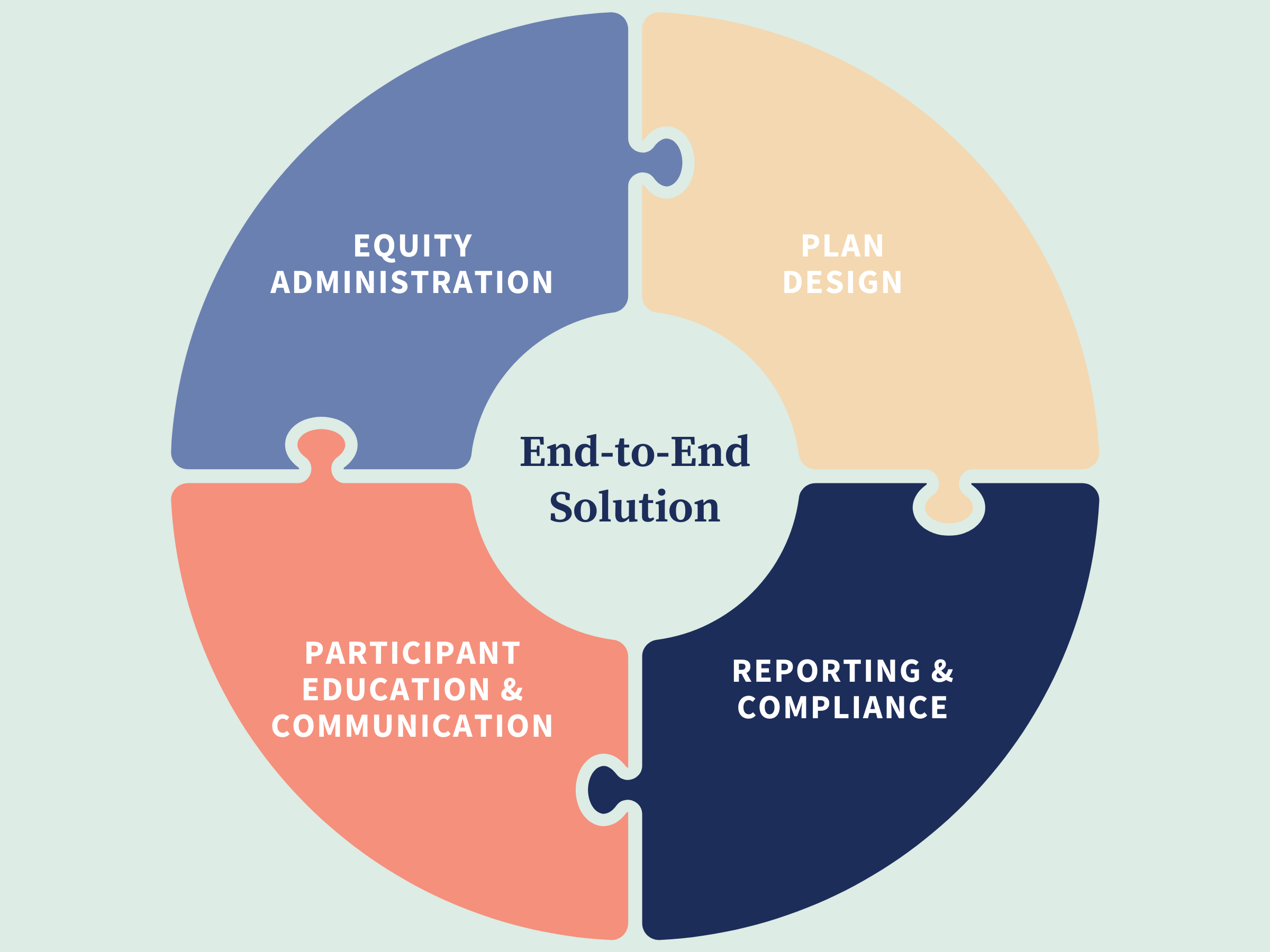

End-to-End Equity Solutions.

We help companies make the most of their equity compensation plans.

Get More Bandwidth

Benefit from our specialized knowledge of complex equity regulations, tax implications, and best practices for administrating complex or unique stock plans.

Reduce Costs

We will handle the support and maintenance of your stock plan platform, utilizing it for grant agreement acceptance, standardizing vesting schedules, processing vesting events, exercises and evaluating grant value vs perceived value and more.

Deliver Seamless Compliance

Gain controls around data security and improve internal processes for grant issuance, vesting calculations, and settlement that often eliminate bottlenecks.

Improve Participant Engagement

Empower your employees with custom communications plans that meet employees at the right time in their award lifecycle.

Make an impact with us.

Maintain Success with Expert Help

Let's connect to get started...

10%

Of Fortune 500 Companies Supported

100%

Employee-Owned

90%

Of Clients Engaged in Multiple Lines of Services

Infinite

Unlocked When You Empower Your Teams.

Comprehensive Support for

Morgan Stanley at Work Clients

Consulting and Advisory Services

Our team delivers strategic insights, advise on best practices, and assist with specific compliance requirements. Additionally, we offer a comprehensive health check of your current equity plan, ensuring that all aspects of your program are optimized for success.

Plan Design & Technical Accounting

Every plan is designed on a one-to-one basis, so you can be assured that it meets your specific company goals. We’ll work with you from the inception of your equity philosophy through the life of your grant, combining our technical accounting knowledge to avoid unintended outcomes.

Global Administration & Complex Plans

Our outsourcing model isn’t a one-size-fits-all approach — it provides a scalable solution for rapid growth and global or complex plans. Each company’s size, plan complexity, and budget are all factors that determine the way we manage your account.

Custom Communication Plans

We develop tailored communication plans that meets employees at the right time in the award lifecycle, ensuring your employees at the receive information when they need it most, fostering a deeper connection with their equity journey.

Meet Your Expert Team

Geoff Hammel

Managing Director

Jen Tardif

Director

Allison Genovese

Director

Yael Elbaz-Roiter

Stock Plan Management Senior Consultant

Nadine Franczyk

Senior Stock Plan Administrator

Ellen Perez

Senior Stock Plan Administrator

Chris Liguori

Stock Plan Administrator

Jacqueline Kolhlf

Sr. Associate Stock Plan Administrator

Candince Bundang

Stock Plan Administrator

Joe Fish

Director

Jason Thompson

Sr. Associate Stock Plan Administrator

Staci Ho

Stock Plan Administrator

Tom Rice

Senior Manager of Stock Plan Administrator

Zynquwandria Stokes

Senior Equity Comp. Associate

Katie Litke-Avery

Equity Project Administrator

Carlos Viitanen Corberán

Stock Plan Administrator

Becky South

Stock Plan Administrator

Kelsey Fisher

Sr. Associate Stock Plan Administrator

Ally Ragonese

Sr. Associate Stock Plan Administrator

Stacy Tracey

Sr. Stock Plan Administrator

Employee equity awards are a popular way for multinational companies to reward and retain their workforce. However, the technical and administrative complexities of global tax withholding can be daunting. In this article, we will explore some practical solutions to navigate these requirements.

Global stock option and Restricted Stock Unit (RSU) programs have become essential tools in equity compensation, especially if you’re a company with an international presence. In this article, we share some strategies to help you with planning and execution including the importance of navigating diverse regulatory landscapes, optimizing tax strategies, ensuring effective communication with your employees, and more.

PvP data can be leveraged to assess whether executive compensation exceeds the market and how it aligns to the return realized by shareholders over that same period. In this publication, we share what you need to know about using the SEC’s new pay vs. performance disclosure to inform decisions about executive pay.