The SEC announced the adoption of its new pay for performance rules, or Item 402(v) on August 25, 2022. The rules were first proposed in 2015, and a subsequent comment period on the proposal occurred in January of this year. The goal of the new rules is to improve consistency and transparency for shareholders with regard to executive compensation.

The finalized rules feature a few significant changes from the initial proposal in 2015. The window to implement these changes is also short, as the new rules are effective for fiscal years beginning after December 16, 2022. So calendar year-end registrants must address them in their 2023 proxy statements. With that fast-approaching deadline in mind, we provide an overview of the rules and considerations to evaluate now in preparation for the new disclosure. Smaller reporting companies (SRCs) have a scaled back disclosure, which we’ll discuss in a later Alert.

Pay Versus Performance

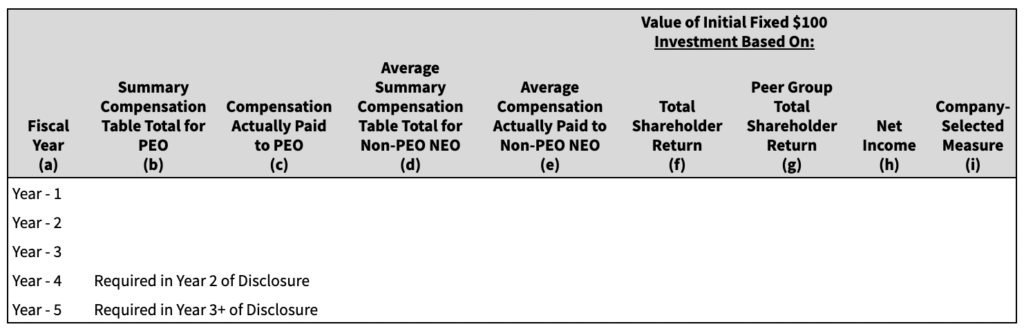

The new rule implements the pay versus performance disclosure requirement under Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”), to link executive compensation actually paid, the financial performance of the company, and change in the total shareholder return (“TSR”) of the company. The heart of the disclosure is the Pay Versus Performance Table, as illustrated below. The disclosure builds from three years to five years as follows:

- Year 1 – 3 years of information

- Year 2 – 4 years of information

- Year 3 and beyond – 5 years of information

We’ll discuss the key elements of the disclosure, the corresponding narrative, and what action you should be taking now to prepare.

1. Determination of Executive Compensation Actually Paid

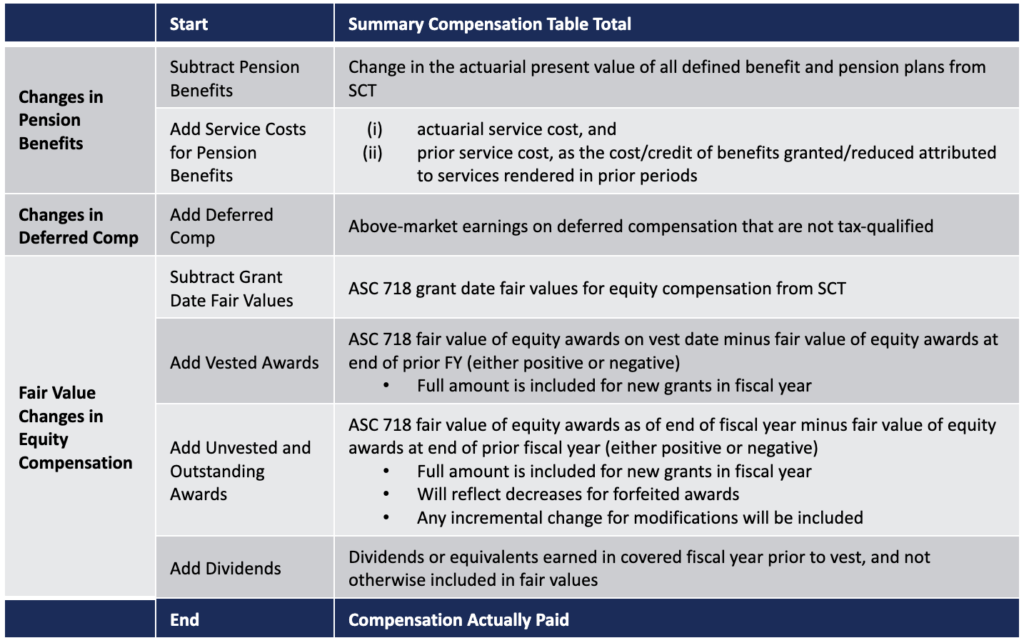

The definition of “Compensation Actually Paid” starts with the disclosed compensation from the Summary Compensation Table (“SCT”). Then, it adjusts for changes in pension benefits, above market earnings of deferred compensation, and employee equity.

The following chart summarizes the calculation from SCT total to Compensation Actually Paid.

Thus, employee equity must be valued at the end of each fiscal year until the vest date. While for some types of equity this process will be fairly straight forward (i.e., RSUs and PSUs with performance conditions), others will require valuation models and new sets of assumptions, which may be complex (i.e., stock options and PSUs with market conditions). Below we summarize considerations for each type of equity that will be subject to re-measurement.

RSUs

- The fair value is the stock price, less the present value of future dividends, if applicable

- Apply an illiquidity discount for post-vest holding periods until restrictions lift, if applicable

- Accrued dividends will be added back separately

Stock Options or Stock Appreciation Rights

- The methodology for developing an expected life can be challenging for options/SARs, especially for awards that are not at-the-money. Frequently a binomial model or Monte Carlo simulation would be used to estimate the fair value or expected life of such an option. We believe there to be 4 reasonable approaches that would be easy for companies to administer (many of which companies are already performing), and listed in order of complexity, but also with improving levels of accuracy..

- Midpoint approach: This approach is allowed for “plain vanilla” at-the-money stock options and represents the midpoint of the future exercisable term. At the point of vesting, however, it is unlikely that the awards will be at-the-money. As actuaries and valuation professionals, we believe that the midpoint approach is reasonable, and should be acceptable for these disclosures. A great percentage of companies are already applying this approach for grant date valuations.

- IRS Revenue Procedure 98-34: This revenue procedure sets forth a methodology to value certain compensatory stock options. Revenue Procedure 98-34 provides an approach to determine the “Computed Expected Life” of an option by multiplying the remaining contractual term of an option by the ratio of grant-date expected life to original contractual term. Volatility and dividend yield would be based on the recent financial statement disclosure. These inputs could be used in a “generally recognized option pricing model” (e.g., Black-Scholes-Merton). Many companies are already using this approach for disclosure in the Proxy for generating estimated payments at the time of termination.

- IRS Revenue Procedure 2003-68: This revenue procedure provides guidance on the valuation of stock options solely for purposes of §§ 280G and 4999 of the Internal Revenue Code (which get disclosed frequently in the termination provisions of the Proxy). The revenue procedure provides three (3) Safe Harbor tables (for Low, Medium, and High Volatility) companies. The benefit of these Safe Harbor tables are that they value stock options as a function of both “moneyness” and “time”. Many companies are already using this approach for disclosure in the Proxy for generating estimated payments at the time of termination.

- Research Study by Jennifer Carpenter, Richard Stanton, and Nancy Wallace / Society of Actuaries – The SEC in SAB107 alluded to a study of exercise behavior (page 35). This research is now completed and publicly available after being published in the Journal of Finance, although it is not in a format generally consumable by corporate issuers. That being said, the community of valuation professionals think that this aggregate data is preferred to other valuation approaches and is a long-term solution in a scalable way. We believe that the behavior summarized in this research could be scaled into easily digestible actuarial tables.

- Apply illiquidity discount for post-vest holding periods until restrictions lift, if applicable

PSUs with Performance Conditions

- The fair value is the stock price, less the present value of future dividends, if applicable

- Apply probability assessment as of fiscal year end consistent with expense accrual

- Apply an illiquidity discount for post-vest holding periods until restrictions lift, if applicable

- Accrued dividends will be added back separately

PSUs with Market Conditions

- Monte Carlo simulation will generally be required to estimate fair value

- Updated assumptions and performance to date incorporated into fair value

- Apply illiquidity discount for post-vest holding periods until restrictions lift, if applicable

- Accrued dividends will be added back separately

2. Disclosure of Key Performance Measures

Finally, the new standard requires the disclosure of three key performance measures:

- Company and Peer Group TSRs

- Net Income

- A “Company-Selected Measure”

TSR should be calculated consistent with the current Stock Performance Graph in Item 201(e) of Regulation S-K. Companies can choose to utilize the same peer group in the performance graph in the 10-K, or alternatively utilize the market-cap weighted TSR of the peer group disclosed in the CD&A. Note that if you opt to disclose the TSR of your compensation peer group, and if the peer group changes from the prior year, then it must be disclosed in a narrative, and also illustrate the TSR of both groups.

Net Income was chosen to help illustrate an interesting contrast against TSR.

A Company-Selected Measure should be included as the “most important” out of the 3 – 7 performance measures from the previous section. However, it must be a financial performance measure (as opposed to a non-financial performance measure such as ESG).

3. Tabular list of “Most Important” Performance Measures

Companies must also disclose between 3 (minimum) to 7 (at maximum) of their “most important” performance measures, as determined by the value attributed in the Compensation Actually Paid. These “most important” performance measures can be financial measures (operational or market conditions) as well as non-financial measures (for example, ESG goals).

SEC Chair Gary Gensler commented on these new disclosures specifically:

“I am pleased that the final rule provides for new, more flexible disclosures that allow companies to describe the performance measures it deems most important when determining what it pays executives.”

The flexibility is certainly noteworthy. There is no requirement for companies to rank or order their 3 – 7 most important measures, except for the most important measure which is the Company-Selected Measure in the Pay Versus Performance Table. Plus, new classifications allow for metrics like time-based stock options to be used as financial performance measures.

4. The Narrative

Finally, companies must describe the relationship between each financial performance measure disclosed (i.e., TSR, net income, and the Company-Selected Measure) in the Pay Versus Performance Table and the Compensation Actually Paid to the PEO and NEOs. Companies may utilize graphs to represent these relationships.

Navigate the New Regulations with Ease

Infinite Equity continues to examine the new pay for performance rules and how they will impact both the executive and equity compensation community. For more information on the new pay for performance regulations or assistance navigating these changes, reach out to us at Infinite Equity for help.

Five Practical Improvements for Modernizing Executive Compensation Disclosure

Reframing Compensation Actually Paid, TSRs, and the CEO Pay Ratio into the SCT