Volatility is one of the most impactful assumption inputs when valuing employee equity. It also requires judgement, as ASC 718 lays out criteria to consider, versus a prescribed methodology.

The following summary highlights the impact of volatility on different types of employee equity:

- Employee Stock Options

- Performance Shares based on Relative Total Shareholder Return (RTSR)

- Performance Shares based on Absolute TSR (“Hurdle Awards”)

We discuss each of these different instruments in detail below.

Impact of Volatility on an Employee Stock Option

Higher volatility means wider stock price swings – both upward and downward. An option with higher volatility will have a higher fair value than one with lower volatility because of the potential upside in value of a large increase in stock price. This leveraged effect occurs since the value cannot be below $0, whereas tail outcomes for increases in stock price could be very valuable.

The following example illustrates the difference in fair value for an option with 30% volatility versus 60% volatility, keeping the other Black Scholes inputs the same.

Example:

| Assumption | 30% Volatility | 60% Volatility |

|---|---|---|

| Stock Price | $10 | $10 |

| Stock Price | $10 | $10 |

| Expected Term | 6.00 | 6.00 |

| Expected Volatility | 30% | 60% |

| Risk-Free Rate | 5.00% | 5.00% |

| Dividend Yield | 0.00% | 0.00% |

| Fair Value as a % of Stock Price | 39.90% | 60.60% |

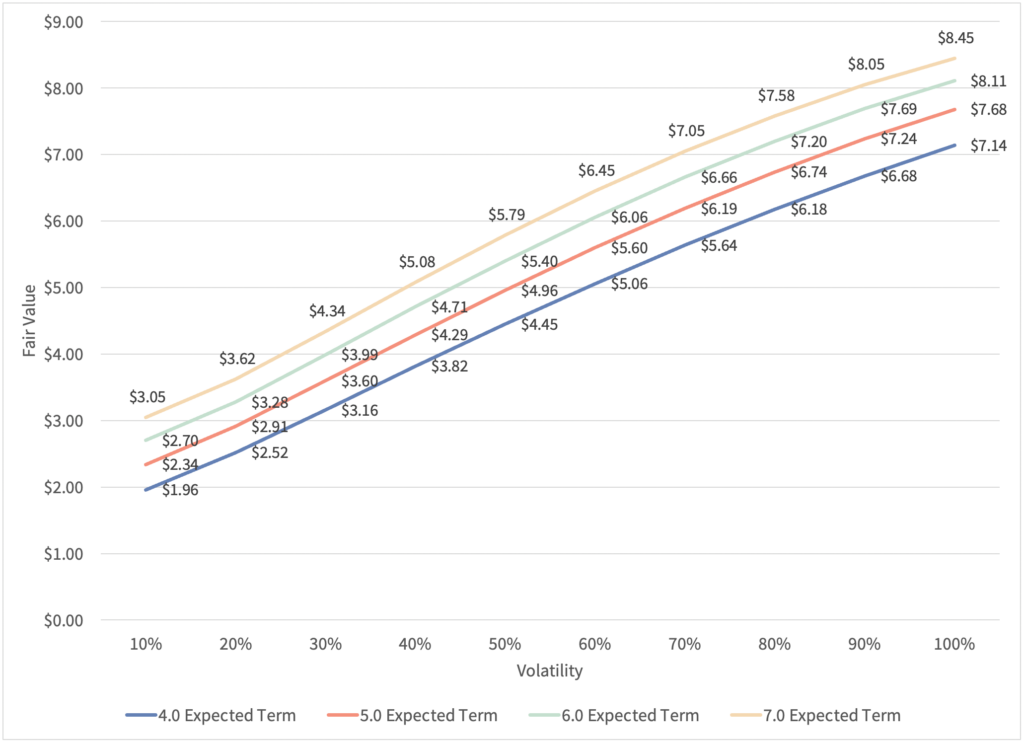

Additionally, the following graph depicts how volatility affects the fair value using four different expected terms, each of which are similarly affected by changes in volatility.

Infinite Equity Commentary: An increase in volatility by approximately 1000 Basis Points (BPS) increases the fair value of an employee stock option by approximately 750 Basis Points (BPS)

Impact of Volatility on PSUs based on RTSR

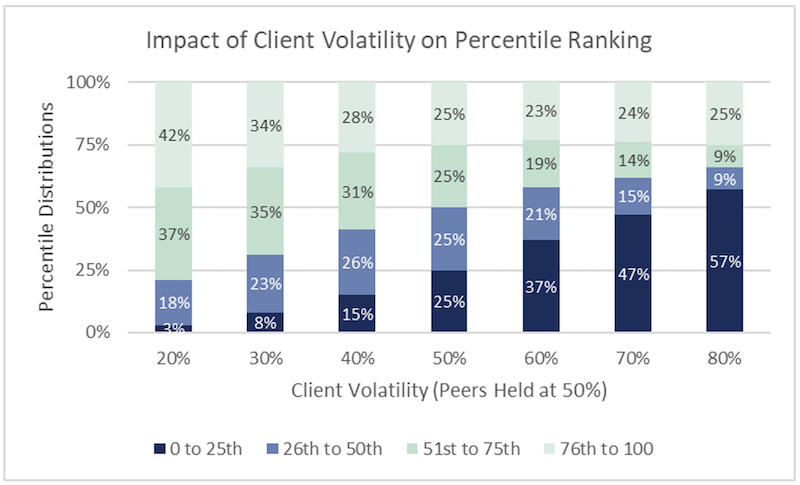

For Relative TSR awards where vesting is also a function of peer returns, both the company and peer volatility have an impact on the valuation.

If the company volatility increases while the peers remain unchanged, the fair value may decrease since the impact of higher possible stock prices is offset by a higher probability of underperforming the peers; this is offset by the increase in stock price at higher payouts.

If the peer volatility increases while the company volatility remains unchanged, the fair value may increase due to the company outperforming the peers more frequently in the simulations.

Infinite Equity Commentary: For every 1000 Basis Points (BPS) increase in excess of your peers, it could be anticipated that your ending percentile will drop by approximately 8 percentile points. However, the decrease in earnout is more than offset by the increase in stock price. Therefore, the ultimate change in fair value generally increases by 2000 basis points.

Impact of Volatility on Performance Shares based on ATSR

Volatility also impacts performance awards that are based on absolute stock price achievement, sometimes known as “hurdle awards”.

Example: Company ABC grants a PSU such that vesting is contingent on reaching a 20-trading day average stock price target of both 150% (Tranche 1) and 300% (Tranche 2) above the price on the date of grant over a 3-year performance period. (For this example, we have fixed the risk-free rate at 5% and with no dividend yield). The following chart illustrates the impact in fair value for both Tranches using a volatility ranging from 30% – 60%.

Hurdle Level | 30% Volatility | 40% Volatility | 50% Volatility | 60% Volatility | ||||

|---|---|---|---|---|---|---|---|---|

| % Achieve | Fair Value | % Achieve | Fair Value | % Achieve | Fair Value | % Achieve | Fair Value | |

| 300% Hurdle | 2.5% | 7.2% | 6.7% | 20.1% | 10.9% | 34.2% | 14.0% | 44.7% |

| 250% Hurdle | 5.9% | 14.8% | 11.4% | 29.7% | 16.3% | 44.0% | 18.4% | 50.8% |

| 200% Hurdle | 14.1% | 27.8% | 20.9% | 42.9% | 26.2% | 55.2% | 29.0% | 63.0% |

| 150% Hurdle | 36.0% | 55.1% | 41.2% | 65.3% | 44.4% | 71.6% | 46.0% | 78.7% |

Infinite Equity Commentary: On average, an increase in volatility by approximately 1000 Basis Points (BPS) increases the fair value of an employee PSU by 1100 Basis Points (BPS). On average, an increase in the hurdle by approximately 1000 Basis Points (BPS) decreases the fair value of an employee PSU by 250 Basis Points (BPS).

The higher volatility allows more upside to the stock price and allows the high stock price goal to be achieved more often than the lower volatility scenario.

Conclusion

Choosing a volatility methodology is important for companies since the assumption is so impactful, therefore it is important for companies to be very thoughtful in selecting the assumption. To learn more about the considerations in selecting volatility, read Infinite Equity’s brief: Understanding Volatility in Stock-Based Compensation Valuation: A Guide to ASC 718 and SEC SAB #107