Volatility is one of the key assumptions that goes into the valuation of stock-based compensation. This brief will reference literature from ASC 718, SEC Staff Accounting Bulletin #107, and Infinite Equity’s research.

FASB ASC paragraph 718-10-55-36 describes volatility as “a measure of the amount by which a financial variable such as a share price has fluctuated (historical volatility) or is expected to fluctuate (expected volatility) during a period. Volatility also may be defined as a probability-weighted measure of the dispersion of returns about the mean. The volatility of a share price is the standard deviation of the continuously compounded rates of return on the share over a specified period. That is the same as the standard deviation of the differences in the natural logarithms of the stock prices plus dividends, if any, over the period. The higher the volatility, the more the returns on the shares can be expected to vary—up or down. Volatility is typically expressed in annualized terms.”

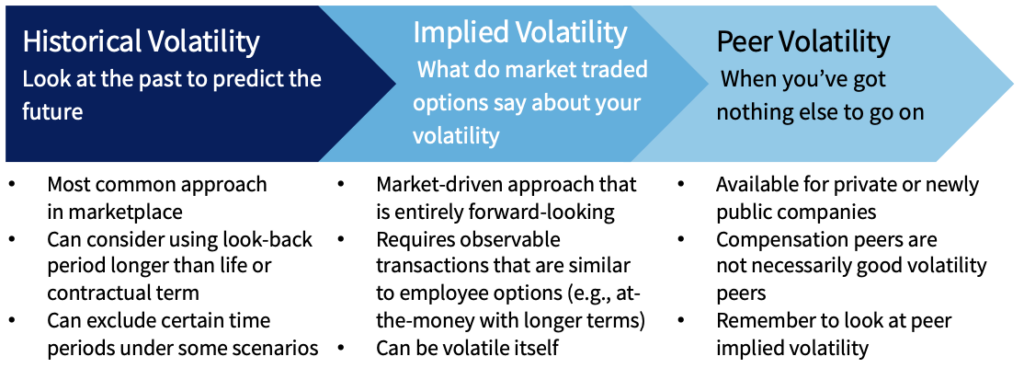

There is not an explicitly prescribed method for choosing how to estimate volatility. A company can use historical, implied, or a combination of both, as long as the considerations below are followed and accurately apply to the company. A group of peers can also be used to determine volatility when the company does not have enough trading history of its own to develop expected volatility. Whichever method is chosen should be applied consistently whenever volatility needs to be estimated.

ASC 718-10-55-37 states some factors to consider in estimating expected volatility:

- Volatility of the share price over the contractual or expected term

- The implied volatility of the share price determined from the market prices of traded options

- The length of time a company’s shares have been publicly traded

- Regular and appropriate intervals for price observations

- Corporate and capital structure

Historical Volatility

The historical volatility method is when the company uses the historical stock prices over a given time period to determine the expected volatility of the company. Historical volatility can be calculated by taking the standard deviation of the natural log of the daily historical close prices and multiplying it by the square root of the total trading days in the year (~252).

A summary of the considerations when estimating historical volatility from SAB Topic 14.D, Certain Assumptions Used in Valuation Methods:

| Question 2: What should Company B consider if computing historical volatility? |

| 1. Method of Computing Historical Volatility |

| 2. Amount of Historical Data |

| 3. Frequency of Price Observations |

| 4. Consideration of Future Events |

| 5. Exclusion of Periods of Historical Data |

- Method of Computation

- What will the look back be; expected term (closed-form model; Black Scholes) or contractual term (open-form model; lattice or monte carlo model) of the option?

- Should closing stock prices be used, or a volume weighted average price (VWAP) for a given price observation?

- Amount of historical data

- In order to rely solely on their own historical data, the company should have enough of their own trading history to cover the length of the look-back period.The look-back period will typically be equivalent to the contractual or expected term of the option depending on the model being used to calculate the value.

- Companies can choose to use a longer time period than the expected or contractual term if they believe the additional time period is relevant and it will produce a better estimate for future volatility, as it has been proven that volatility reverts to the longer term mean.

- Frequency of price observations

- The company has the option to choose between daily, weekly or monthly data points. SEC Staff Accounting Bulletin #107 states “if shares of a company are thinly traded the staff believes the use of weekly or monthly price observations would generally be more appropriate than the use of daily price observations.” Infinite Equity has also observed that the use of daily closing prices tends to overestimate the calculation of historical volatility.

- Companies should consider the frequency of the trading of their shares and amount of trading history when determining which frequency to use to estimate volatility.

- Consideration of future events

- If events in the future are known about, i.e. a merger / acquisition, then that should be factored into the volatility calculation if the company believes that the event will impact the stock price.

- Companies must consider whether the information regarding future events is considered material nonpublic information.

- Exclusion of periods of historical data

- Companies can choose to exclude certain time periods from their volatility calculation if they believe the events triggering the change in stock price aren’t indicative of future performance. However, companies should be prepared with supportive reasoning about why this time period should be excluded. Exclusionary periods should be based on company specific events, rather than macroeconomic/stock market conditions.

- Companies can choose to place more weight on implied volatility if they cannot provide sufficient evidence that certain time periods in the past are not indicative of future performance.

While most companies rely on historical volatility, it must be considered whether the past is indicative of the future.

Implied Volatility

ASC 718-10-55-37 (b) states “The implied volatility of the share price determined from the market prices of traded options or other traded financial instruments such as outstanding convertible debt, if any.” Implied volatility is reflective of historical volatility and expectations of how future volatility will differ from historical volatility.

A summary of the considerations when estimating implied volatility from SAB Topic 14.D, Certain Assumptions Used in Valuation Methods:

| Question 3: What should Company B consider when evaluating the extent of its reliance on the implied volatility derived from its traded options? |

| 1. The volume of market activity of the underlying shares and traded options |

| 2. The ability to synchronize the variables used to derive implied volatility |

| 3. The similarity of the exercise prices of the traded options to the exercise price of the employee share options |

| 4. The similarity of the length of the term of the traded and employee share options |

- The volume of market activity of the underlying shares and traded options

- Companies should consider how actively traded their shares and options are when deciding whether implied volatility is an appropriate measure. Note that the determination of “actively traded” is very subjective, and the bulk of option contracts are bought and sold on the same day.

- Ability to synchronize the variables used to derive implied volatility

- Market prices of the traded options and shares granted should be calculated at the same point in time.

- The similarity of exercise prices of traded options to the exercise price of the employee share options

- If available, at or near the money options should be used to derive the implied volatility for at the money options granted to employees.

- If at or near the money options are not available, the company should use multiple options where the average of the strike prices is similar to the option granted to the employee

- The similarity of the length of the term of the traded and employee share options

- Options with similar term lengths should be used to derive implied volatility but if there are not any available then options with 6 or more remaining months should be utilized.

Peer Group Volatility

- If newly public companies (less than two years of trading history) need to estimate their volatility they may choose a group of peers in similar size and industry to themselves and estimate their volatility based on one of the methods above.

- ASC Topic 718-10-55-37 provides that:

- “A newly public entity also might consider the expected volatility of similar entities. In evaluating similarity, an entity would likely consider factors such as industry, stage of life cycle, size, and financial leverage. A nonpublic entity might base its expected volatility on the expected volatilities of entities that are similar except for having publicly traded securities.”

- The Securities & Exchange Commission (the “SEC”) in Staff Accounting Bulletin 107 (“SAB 107”) provides that the SEC Staff a company can “utilize a period of historical data longer than the expected or contractual term, as applicable, if it reasonably believes the additional historical information will improve the estimate.” For companies that don’t have a long-term trading history, peer group data may be indicative of the long-term mean and is often used as a proxy.

- Companies should consider the following when selecting which peers to use in order to estimate their own volatility:

- Peers used in other peer groups by the company, i.e. compensation peers

- Industry – companies should select companies within the same or a similar industry or GICS group

- Exchange – the peers selected should be traded on a major exchange

- Revenue – the peers selected should have revenue within a similar range of the company (for example, roughly 0.5x – 4x of the company’s revenue)

- Market Cap – the peers selected should have market cap within a similar range of the company (for example, roughly 0.5x – 1.5x of the company’s market cap)

- Years Public – the peers should have at least three years of their own trading history

- Debt Leverage – companies with a significant amount of debt tend to have a higher volatility than those without debt. If your peers have different financial leverage, then it may be necessary to adjust historical volatility calculations for debt leverage using the Merton Model.

- Note that a reasonable starting point for peers may be your Executive Compensation peer group. However, the companies that you use for benchmarking compensation programs may be very different than the companies that should be used for benchmarking stock price volatility.

- As time goes on and the company begins to develop its own trading history it can place a proportional weight on its own trading history alongside the volatility of the peer group.

Conclusion

ASC718 allows significant flexibility in the approaches for estimating expected volatility, ranging from Historical calculations (using many different approaches), Implied volatility seen in the warrants or convertible debt, or even peer group volatility. Most important, however, is selecting an appropriate process and applying it consistently. Infinite Equity can help your organization determine the best process for selecting volatility, and work with you to apply that on an ongoing basis. To learn more about how the volatility selection impacts the fair value of your equity awards, review Impact of Volatility on Fair Value.