What is an ESPP, how does it work, and what benefits can it provide to employees?

What is an ESPP?

An Employee Stock Purchase Plan (“ESPP”) is an employee benefit plan that allows employees to purchase company stock through payroll deductions, with the benefit of a discount or company match to encourage participation. These broad-based programs provide companies a cost effective way to extend ownership opportunities to employees.

Types of ESPPs

| Qualified | Non-Qualified |

|---|---|

| Qualified under IRC Section 423 to provide preferential tax treatment for employees | Simpler but less favorable tax treatment for employees; automatic tax deduction for company |

| Majority of U.S. plans are qualified | Not as prevalent in U.S. but utilized for global employees |

| Design must adhere to certain conditions such as broad-based eligibility with limited exclusions and limitations on shares purchased | Greater flexibility and creativity in design than qualified ESPPs, including eligibility rules and benefits such as a match |

Key Terms and Features

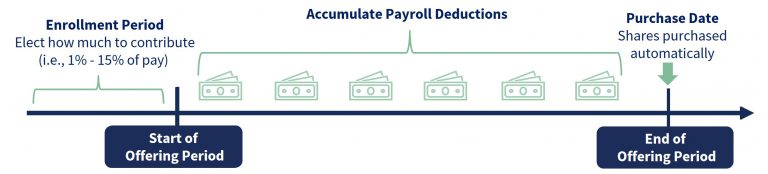

| Enrollment Period | Employees elect a percentage of their salary to contribute; deduction percentage chosen is based on the employee’s gross pay, but is deducted from their after-tax pay (i.e., shares are purchased with after-tax dollars). |

| Offering Period | Specified period of time over which employee contributions accumulate (i.e., six months). |

| Purchase Date | Predetermined date, typically at the end of the offering period, when employee contribution funds accumulated during the offering period are used to purchase stock. |

| Discount or Match | Most U.S.-style plans allow employees to purchase shares for a set percentage lower than the fair market value of the company stock at the time of purchase (i.e., 15%). Alternatively, many European-style plans deliver the “benefit” through an employer-match concept (i.e., 25% matching contribution). |

| Lookback | Popular feature for U.S.-style plans that applies the discount to the lower stock price at either the beginning or the end of the offering period. |

Don’t Overlook This ESPP Requirement: Reporting Qualifying Dispositions

As year-end reporting picks up, one topic always creates questions: qualifying dispositions under a Section 423 ESPP. Companies of all sizes still struggle with whether...