As interest rates increase, companies should optimize ESPP valuation by reducing fair value for interest foregone.

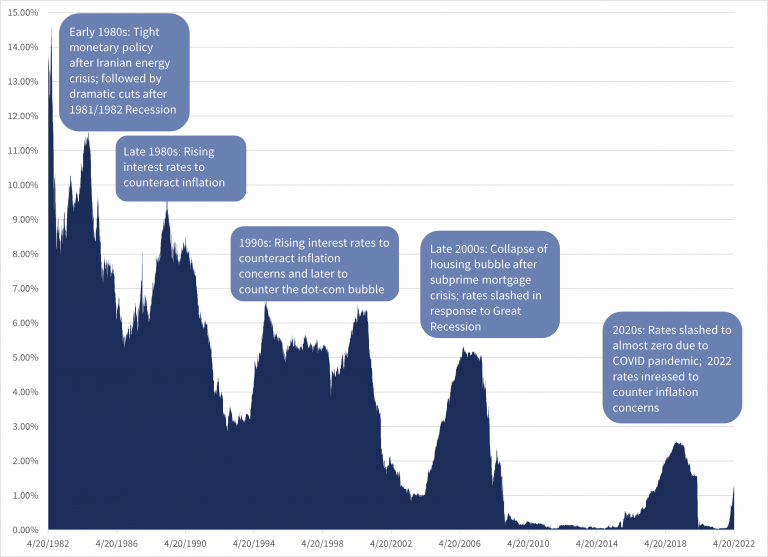

Most experts anticipate that the United States will continue to increase interest rates during 2022. Over the last 20 years, interest rates have been historically low. The picture below illustrates the last 40 years for the 6-Month Treasury Rates. Note that over the last 40 years, it has ranged from a low of .02% to a high of 14.57%.

Although interest rates may not increase to levels we have seen in the past, it can be anticipated that rates will increase. One downstream effect of an increase to interest rates will be how that will play into the valuation of your employee equity, and specifically your Employee Stock Purchase Plan (“ESPP”). In a prior research article, we summarized 4 Missing Pieces that many companies neglect to reflect in their valuation under ASC718.

The intent of this article is to provide more detail on the impact of the first of the 4 Missing Pieces – Interest Foregone – and the materiality caused if it is neglected from the fair value. As a reminder, guidance around ESPP plans can be found in ASC 718-50-55 (formerly FASB Technical Bulletin 97-1), which states that interest foregone should be deducted from the fair value of an ESPP share. Paragraph ASC 718-50-55-9 states:

“This Example does not take into consideration the effect of interest forgone by the employee on the fair value of an award for which the exercise price is paid over time (for instance, through payroll withholdings). Awards for which part or all of the exercise price is paid before the exercise date are less valuable than awards for which the exercise price is paid at the exercise date, and it is appropriate to recognize that difference in applying the guidance in this Subtopic. However, for simplicity, the effect of forgone interest is not reflected in the fair value calculations in this Example.“

Note that most equity administration software systems do not reflect for interest foregone (potentially because the example in the accounting standard did not include it).

To reduce a valuation for interest foregone, first we should make an assumption about when payroll deductions occur from a paycheck. Since most companies have bi-weekly or bi-monthly payroll deductions, it can generally be assumed that during a 6-month purchase period of an ESPP plan, the average payroll deduction has occurred in the middle of the 6 month period, or around 3 months. Therefore, it can be assumed that the participant has foregone 3 months worth of accrued interest by contributing towards the ESPP. (After all, the alternative would be for the deductions to be in a bank account accruing interest). As interest rates increase, the participant would be able to accrue more interest (or, in other words, have more interest foregone).

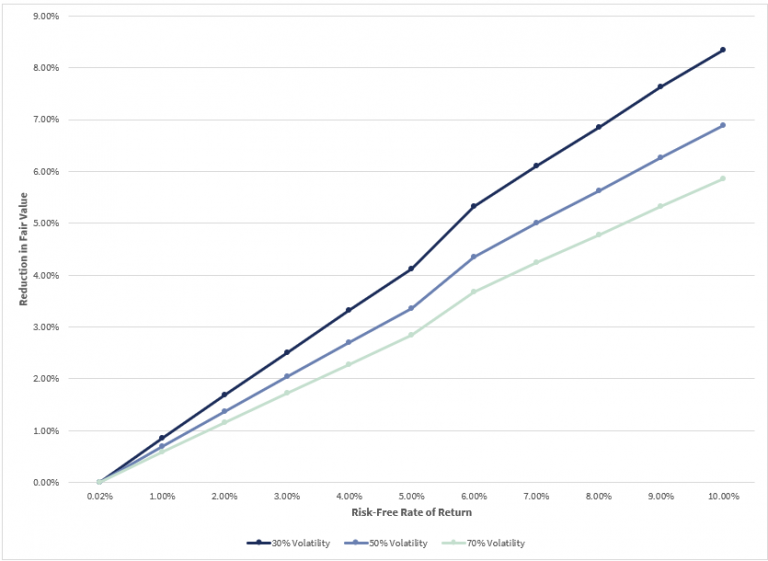

The next chart illustrates the impact of “interest foregone” and the materiality of the reduction as interest rates increase ranging from the low of .02% to a high of 10% (recall that 6-month treasury rates have been as high as 14.57% in the last 40 years), for expected volatilities ranging from 30% to 70%.

For example, the estimated fair value of an ESPP for a company with 50% volatility and a 5% risk-free rate is 28.8% of the stock price if it considers the reduction for interest foregone, and 29.8% of the stock price if it does not include interest foregone. This represents a 3.4% decrease in the fair value without changing any plan features. Note that common 6-Month Treasury Rates ranging between 4%-6% will create a 3%-5% reduction for every single share purchased by an ESPP. This reduction is free accounting reduction, as it is clearly acceptable by the accounting standard, and it is a more appropriate valuation.

Are you applying interest foregone to your ESPP fair value?

Contact us today to learn how we can help.