The stock option package granted to the CEO of Tesla in early 2018 made significant headlines and waves in the compensation industry. It was decried for its size ($2.3B disclosed value), but it was also applauded for its extreme audaciousness. The first tranche of options could not vest until Tesla market cap grew to $100B (nearly 2x) and the full award cannot vest until $650B (nearly 12x). These market cap growth objectives must be sustained for a 6-month period and require similarly high-growth financial measures (Revenue and EBITDA) to be met.

In a little over 3 years since the grant, Tesla’s market cap is currently trading north of $500B and according to their 10K filed February 2021, four of the twelve tranches have been “achieved and certified” with another two “probable” of being achieved. Elon has become one of the richest persons in the world, and Tesla’s shareholders have enjoyed significant returns.

The Ripple Effect

A stone cast into a body of water will create a ripple effect in all directions. A few dozen public and late-stage private companies have issued their own “Elon-esque” grants to their CEOs and Founders over the past 3 years. Here are just a few disclosed in this wake: AirBnb, Affirm, DoorDash, GoodRx, Guardant Health, OpenDoor, and Sorrento Therapeutics. These awards are notable for the sheer size and aggressive growth-oriented performance metrics but were not particularly innovative.

However, there is one company that stands out, not for what they issued to their CEO, but for what they did next. Axon Enterprise (AXON) created the eXponential Stock Performance Plan (“XSPP”) to deliver the magic and excitement of these highly leveraged, predominantly CEO only awards to nearly its entire workforce.

XSPP Explained

The XSPP, a beautiful union of an ESPP and a PSU, delivers “XSUs” to employees. According to Axon’s FAQs:

The purpose of the XSPP is to align every eligible employee with the 2018 CEO Performance Award, which was designed to inspire the CEO to achieve both significant increases in shareholder value and also key company growth milestones. The XSPP is intended to encourage long-term thinking and long-term commitment with an opportunity to earn greater rewards for greater success, albeit with higher risks.

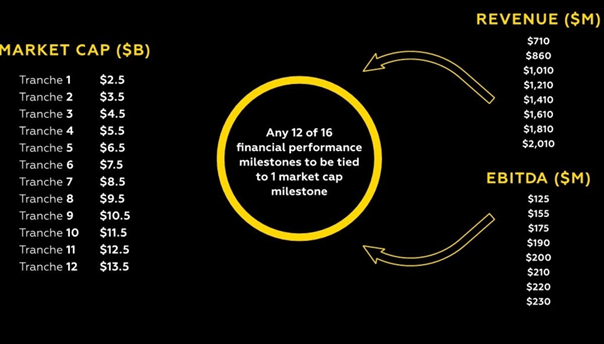

As part of the XSPP, all employees received a grant of 60 XSUs (i.e., performance based RSUs) that can be earn in 12 tranches when a pair of market cap and either a revenue or EBITDA milestones has been achieved:

Certain eligible employees could receive additional XSUs in exchange for giving up a portion of their regular compensation over the 9-year life of the program (2019 to 2027). Every $1,000 of foregone compensation resulted in $27,000 in XSUs granted ($1,000 for 9 years with additional 3x risk factor). Eligible employees chose to forego $75 million of guaranteed compensation in order to more fully participate.

“I’m thrilled at this unparalleled level of commitment and alignment. I believe it will be a game changer, adding rocket fuel to our mission to protect life,” says Axon CEO and founder, Rick Smith

This bold, new approach received overwhelming shareholder support despite its potential for greater dilution, and became an immediate recruiting differentiator for attracting key tech talent. The ability to forego guaranteed compensation in return for the XSUs has the potential to deliver exceptional returns to employees.

The XSPP at Three

We should note the XSPP is technically younger than 3 years old, having been rolled out to employees in late 2018; however, it is aligned with the CEO’s performance grant which just hit its 3-year anniversary. According to Axon’s 10K filed February 2021, the first pair of performance requirements were achieved as of December 31, 2020, and the first tranche of XSUs will vest following certification of results in Q1. And it would appear there are more tranches of XSUs poised to vest over the next few years. The 10K also disclosed that six of the market caps have been achieved and 10 of the remaining 11 tranches are probable of achieving the required financial targets. The value of each XSU is equal to Axon’s stock price which was trading at $140 at the time of this piece.

It is worth noting employees who made elections have already earned a tranche worth 2.3X the amount of foregone compensation over the past 3 years. The ROI is 4.6X if you include the next 5 probable tranches where the market cap has been achieved, and 8.5X if you include all 11 probable tranches (granted the stock price will need to continue to grow).

Unleash the Magic Within Your Workforce

Axon should be applauded for their bold and innovative approach. The decisions of the CEO and top executives may impact the company’s share price most directly, but truly exponential growth requires an engaged and motivated workforce. Drawing a straight line between company performance and the compensation of the broader employee population encourages individuals to behave like owners and go the extra mile. Axon’s CEO said at the time, “We figured out how to scale the Elon Musk magic”.

Equity Compensation 101: Building a Foundation of Ownership and Value