The SEC’s Pay Versus Performance (“PVP”) disclosure rules contain a variety of nuances and complexities, especially for companies that recently went public and must comply with the new rules.

The SEC announced the adoption of its pay versus performance rules, or Item 402(v), on August 25, 2022. A detailed summary of the rules can be found within our Alert found here.

The SEC released Compliance & Disclosure Interpretations (“C&Dis”) on September 27, 2023, which answered specific questions relating to the PVP disclosure, including one that pertains to companies that go public during a year included in the disclosure.

Note that if a company is an emerging growth company (“EGC”), it is not subject to this disclosure. Otherwise, newly public companies that are smaller reporting companies (“SRC”) or large filers are required to include this new disclosure in their proxy statements.

For newly public companies, there are several key nuances:

- Company TSR is measured starting from the IPO date, but there is conflicting guidance from the SEC about whether you use the registration price or the closing stock price on the company’s first trading day.

- The time period to measure compensation actually paid (“CAP”) in the year of IPO is over the entire fiscal year, beginning with the end of the prior fiscal year. This creates a disconnect between TSR measured starting on the IPO date versus CAP measured over the entire fiscal year.

- Complex scenarios arise for companies that go public via a reverse merger when there are executives from the acquirer and the acquired companies. Awards measured prior to the IPO/merger date will correspond to two different companies.

Below, we will explore the considerations for each of these key nuances.

1. What is the starting price for measuring TSR?

The PVP disclosure requires companies to measure TSR based on a initial fixed investment of $100, as required for Item 201(e) of Regulation S-K. Large filers are already making this disclosure in the performance graph in the 10-K.

The guidance for how to measure TSR for a company that goes public during the covered period conflicts between Regulation S-K referenced in the PVP disclosure rule compared to the follow up SEC Staff’s Compliance & Disclosure Interpretations (“CD&Is”).

Question 128D.06 of the SEC Staff’s CD&Is of the PVP disclosure rule states:

“Consistent with the calculation of TSR under Item 201(e) of Regulation S-K, if the class of securities was registered under Section 12 of the Exchange Act during the earliest year included in the “Pay Versus Performance” table, the “measurement point” for purposes of calculating TSR and peer group TSR should begin on such registration date. [February 10, 2023]”

Question 5.04 of the SEC Staff’s CD&I’s for Item 201 Regulation S-K states:

“Question: May issuers choose between using the price shown in the registration statement for an initial public offering, the opening price on the first trading day, or the closing market price on the first trading day when preparing the performance graph?

Answer: No. The issuer should use the closing market price at the end of the first trading day. [March 13, 2007]”

The price on the registration statement may be similar to the closing stock price on the first trading day, but there also can be wide variation once a company goes public. This means companies will use the closing stock price on the first date they are traded for calculating TSR for their performance graph for the 10-K disclosure, and potentially the registration statement price for calculating TSR for the PVP disclosure. Ideally the two TSR measurements would be the same, or there could be confusion among investors about why TSR is different over the same period.

2. What date do I start to measure CAP?

For companies that did not go public during the covered period, the first measurement date is the beginning of the oldest covered fiscal year (i.e., two- or three-year prior fiscal year). For companies that went public during the covered period, the original rules are silent on the starting point to measure CAP. The C&DIs confirm it is the beginning of the fiscal year in which a company goes public.

Question 128D.15 of the SEC Staff’s CD&Is of the PVP disclosure rule states:

“Question: In periods prior to pursuing an initial public offering, a private company may grant stock awards or option awards. Once that company is required to provide Item 402(v) disclosures, should the change in fair value of awards granted prior to the date of a registrant’s initial public offering be based on the fair value of those awards as of the end of the prior fiscal year for purposes of determining executive compensation actually paid?

Answer: Yes. For outstanding stock awards and option awards, the calculations required by Item 402(v)(2)(iii)(C)(1) of Regulation S-K should be determined based on the change in fair value from the end of the prior fiscal year. The fair value of these awards should not be determined based on other dates, such as the date of the registrant’s initial public offering. [September 27, 2023]”

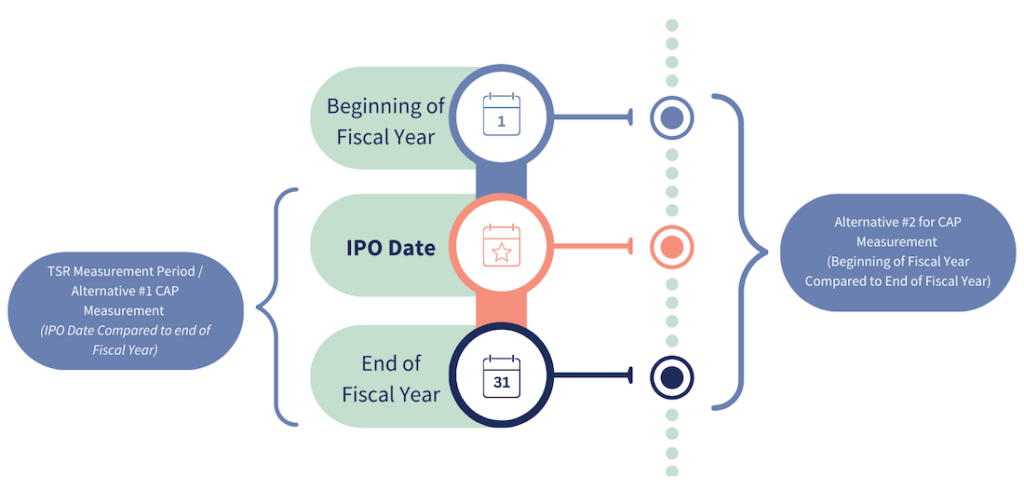

Previously, two dates were possible:

- Alternative #1 (should not be used for proxies after September 27, 2023): The first date the company is publicly traded: Measure all unvested and outstanding equity awards as of the first trading date, which is relatively straightforward to do once public stock price data is available. For that fiscal year, unvested and outstanding equity awards are remeasured at the end of the fiscal year, in order to determine CAP for that year. This approach is simpler, and also aligns to the calculation of TSR which is measured once a company goes public.

- Alternative #2 (must be used for proxies after September 27, 2023): The beginning of the fiscal year in which a company goes public. This emerged as the prevalent approach, for consistency with Summary Compensation Table (“SCT”) values which reflect the full fiscal year. However, this creates a disconnect between the comparison to company TSR and executive compensation actually paid that are now measured over two different periods. Private company values typically accrete rapidly during the several month period leading up to a going public transaction, and so this approach significantly impacts CAP. Beginning equity valuations are based on private company valuations from the beginning of the year that could be months before going public, resulting in very small valuations for the starting point. Then, awards that vest upon going public or that are remeasured at year end are significantly higher than the starting point, resulting in very high CAP values in that year.

This also creates additional complexity to measure outstanding and unvested equity awards before a company has gone public. Company valuations may or may not be available on the specific dates required (beginning of the fiscal year and various vest dates). This requires additional analysis to determine the value of the company’s stock as a private company.

3. Reverse Merger Transactions and Measurement of CAP

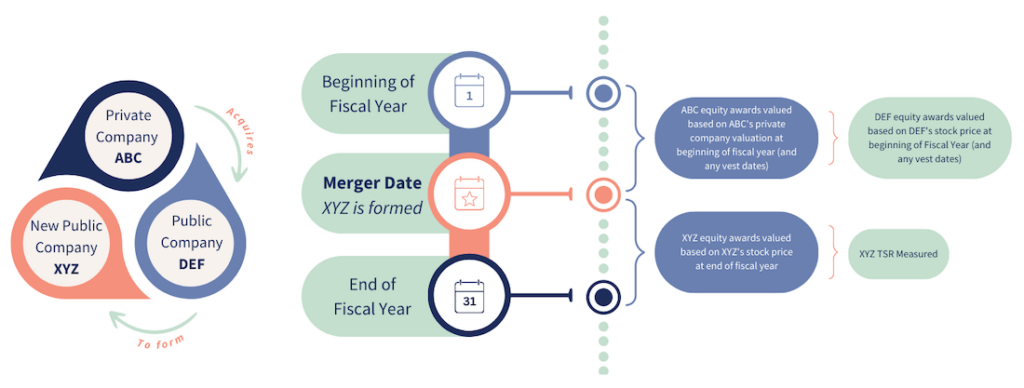

Companies that go public through a reverse merger face unique challenges when there are named executive officers (“NEOs”) from both the acquiring and acquired companies. Because the emerging approach for newly public companies is to measure CAP from the beginning of the fiscal year in which it goes public, this means that there can be equity awards that must be valued prior to the merger date from two separate companies: the acquired public company and the acquiring private company.

After the transaction, all equity awards that must be re-valued will be on the basis of the newly formed public company. This creates similar challenges as described above, where the measurement of TSR is only based only on the new company stock price returns once it is public, but you are comparing changes in equity compensation fair values to a former public company (the acquired company) and a former private company (the acquiring company).

Question 128D.14 of the SEC Staff’s CD&Is of the PVP disclosure rule states:

“Question: Should awards granted in fiscal years prior to an equity restructuring, such as a spin-off, that are retained by the holder be included in the calculation of executive compensation actually paid?

Answer: Yes. All stock awards and option awards that are outstanding and unvested at the beginning of the covered fiscal year or are granted to the principal executive officer and the remaining named executive officers during the covered fiscal year, including those awards modified in connection with an equity restructuring or retained following such a transaction, and for which compensation cost will be recognized under FASB ASC Topic 718 should be included in the table required by Item 402(v)(1) of Regulation S-K. [September 27, 2023]”

The SEC C&DIs confirm that awards granted in fiscal year prior to an equity restructuring, such as a spin-off, that are outstanding and unvested during the covered fiscal years that are modified in connection with an equity restructuring or retained following a transaction, and for which compensation cost will be recognized under ASC 718, should be included in the PVP disclosure. This applies to transactions which create newly public companies, such as a reverse merger.

Next Steps

Because of the unique challenges faced by newly public companies, it is critical to engage key stakeholders early to ensure accurate and compliant disclosures, including internal and external legal counsel, finance, stock administration, and outside valuation experts.

Infinite Equity continues to examine the pay for performance rules and emerging C&DIs and how they will impact both the executive and equity compensation community. For more information on the pay for performance regulations or assistance navigating these changes, reach out to us at Infinite Equity for help.