Considerations and Accounting Implications

Companies considering a relative TSR plan or a change to a current program may want to evaluate a Relative Total Shareholder Return Modifier.

As a company matures, it may face pressure from shareholders and other stakeholders to implement a performance program that utilizes relative total shareholder return “TSR” as a metric. A relative TSR program aligns pay with company performance, as the pay is directly dependent on the company performance against the peer group.

However, there can be challenges in adopting a stand-alone plan, with criticism that the award holder is not directly in control of the stock price. One alternative that incorporates relative TSR but is not fully dependent on relative TSR is a “modifier” type plan. This plan has a primary metric, which is then modified up and/or down. Therefore, the award recipients have direct line of sight into an operational or financial goal first, and then modify with relative TSR to satisfy shareholders and create alignment.

A modifier plan is typically constructed with primary metric as an internal metric (operating goal, financial goal, etc.) and modified up and/or down by relative TSR. However, other variations include the primary metric as relative TSR modified by an internal metric, or even a performance metric modified by absolute TSR performance.

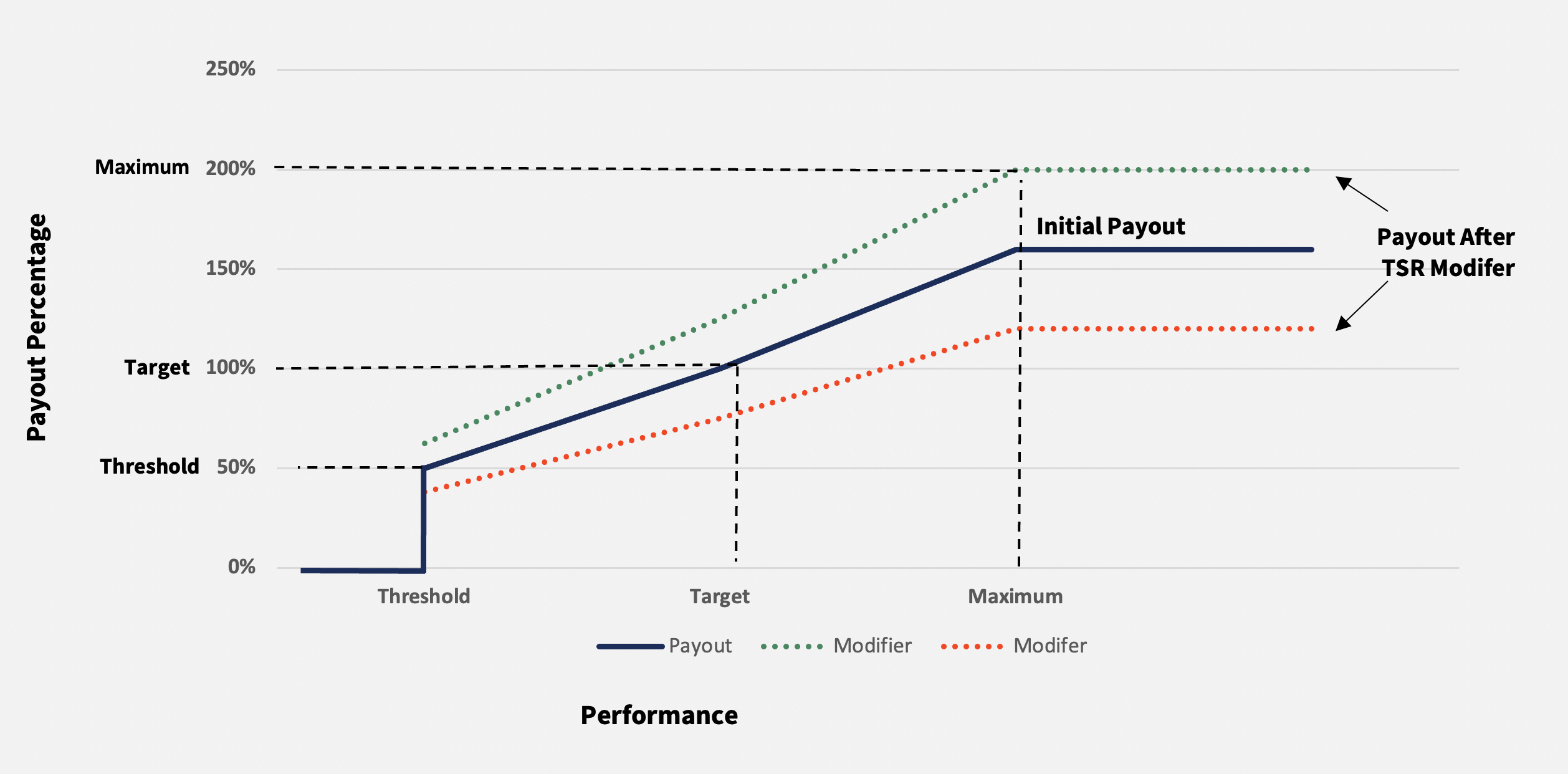

Illustrative Payout Schedule

The graph below illustrates the impact of a +/- 25% modifier to the primary payout schedule where the threshold, target, and maximum are 50%, 100%, and 160% initially.

From an accounting perspective, a modifier plan (with relative TSR as the modifier) will mitigate risk with fixed expense for market conditions since the expense based on the internal conditions can still be adjusted and can be adjusted to $0 if the internal metric is not met. Additionally, there can be more alignment between the actual value delivered and the compensation expense – since a relative TSR modifier provides only a modest adjustment (with the typical maximum adjustment being up or down 25%), the potential difference between actual value delivered and the compensation expense is limited. A more detailed explanation of the accounting implications is in the section below.

For employee perception and understanding, integrated plans are more complicated so award recipients may not understand them if there is not a concerted effort around education. Also, combining multiple goals might cause award recipients to emphasize one goal over another, and it may or may not be the goal that is most important to the company.

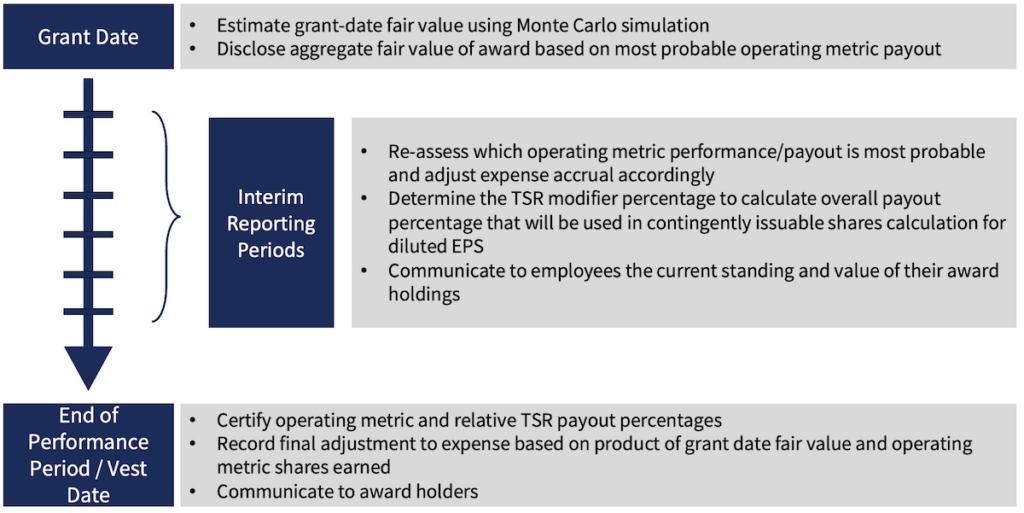

When implementing a relative TSR modifier award, it is critical to understand the accounting implications and related updates needed throughout the performance period. It is also critical to educate award recipients so they appreciate their awards and feel empowered to impact their performance results.

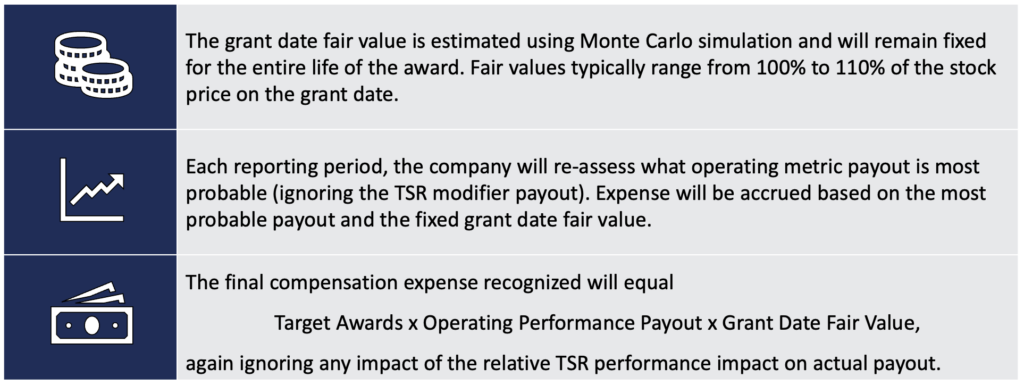

Valuation and Accounting Summary

A relative TSR modifier is considered a Market Condition under ASC Topic 718 and therefore the effect of the TSR modifier must be reflected in the grant date fair value.

Timeline

An illustration of the required activities from the grant date through the end of the performance period is provided below.

Accounting Example

The table below shows the expense accrual process assuming a target award of 1,000 shares with a grant-date fair value of $10.00.

- Value of grant disclosed in proxy will equal the product of i) the target number of awards, ii) the grant-date fair value, and iii) the most probable payout of the operating metric (1,000 x $10 x 100% = $10,000 in example below)

- The relative TSR modifier payout does not affect the expense accrual, as the impact of the modifier is already reflected in the grant-date fair value

- The relative TSR modifier payout will impact the contingently issuable shares used to determine diluted EPS

Conclusion

In conclusion, while the adoption of a relative TSR plan can offer a strong alignment between pay and performance, the implementation of a relative TSR modifier provides a balanced approach that mitigates some of the challenges associated with stand-alone TSR plans. By integrating a primary internal metric with a TSR-based modifier, companies can maintain focus on key operational or financial goals while still addressing shareholder expectations for performance relative to peers. This approach also offers more predictable accounting outcomes and can limit the gap between actual value delivered and compensation expense. However, successful implementation requires a thorough understanding of the accounting implications and a proactive approach to educating award recipients, ensuring they fully understand and appreciate the structure and objectives of their compensation plans. With careful planning and communication, a relative TSR modifier can be an effective tool in aligning stakeholder interests and driving long-term company performance.

Infinite Equity has the experience and skill-set to assist companies of all sizes with their TSR programs. Contact Us for additional information.