The SEC announced the adoption of new pay versus performance rules, or Item 402(v) on August 25, 2022. A detailed summary of the new rules can be found within our Alert found here.

The biggest challenge of the rules is a new definition of pay called “Compensation Actually Paid” (“CAP”). Although the CAP calculation itself is new, the theory behind CAP is not.

CAP represents a combination of both “Realized” and “Realizable” Pay, the latter of which many Compensation Committees have been calculating for years (or at least variations thereof). The calculation of Realizable Pay is an incredibly important exercise for companies to perform since it gives transparency into each executive’s golden handcuffs.

The challenge is to systematically perform the calculation of CAP in the prescribed SEC guidance and translate the abstract results into more valuable and relatable information.

First, here is a recap some of the broad definitions of pay:

Reported Pay: Represents the grant date fair value under ASC718 and disclosed in the Summary Compensation Table.

Realizable Pay: Illustrates the middle of the equity life cycle and estimates the value (fair value or intrinsic value) of the employee equity package prior to vesting.

Realized Pay: The actual pay recognized by the executive at the point of exercise or vesting.

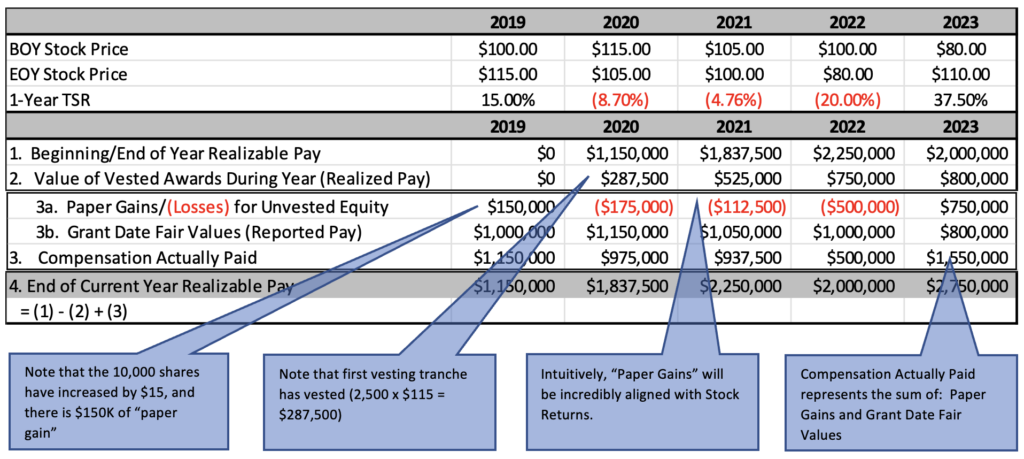

To illustrate this concept, an example of CAP and how to translate it in “Realized” and “Realizable” Pay is provided below.

The example includes a traditional equity grant and ignores other components of compensation from the Summary Compensation Table (Base Pay, Short Term Incentives, and Other Compensation).

Example: Assume a Named Executive Officer (NEO) is awarded a 5-year contract such that on 1/1 for each of the next 5 years, they will be granted 1,000 shares of stock with vesting occurring at 25% on each anniversary over the next 4 years. For purposes of disclosure in the Summary Compensation Table, the “Grant Date Fair Value” will be disclosed as below:

| 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|

| Shares Granted | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 |

| 1/1 Stock Price | $100 | $115 | $105 | $75 | $120 |

| ASC 718 Fair Value | $1,000,000 | $1,150,000 | $1,050,000 | $750,000 | $1,200,000 |

The fair values shown above are clearly defined in the Summary Compensation Table.

Reconciling these grants to Compensation Actually Paid

The guidance for determining Compensation Actually Paid requires a reconciliation from the SCT value to CAP in the footnotes, which may be presented as follows:

Chart A:

| 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|

Summary Compensation Table – Total Compensation(a) | $1,000,000 | $1,150,000 | $1,050,000 | $1,000,000 | $800,000 |

– Grant Date Fair Value of Option Awards and Stock Awards Granted in Fiscal Year | $1,000,000 | $1,150,000 | $1,050,000 | $1,000,000 | $800,000 |

+ Fair Value at Fiscal Year-End of Outstanding and Unvested Option Awards and Stock Awards Granted in Fiscal Year | $1,150,000 | $1,050,000 | $1,000,000 | $800,000 | $1,100,000 |

+ Change in Fair Value of Outstanding and Unvested Option Awards and Stock Awards Granted in Prior Fiscal Years | $0 | ($75,000) | ($62,500) | ($300,000) | $450,000 |

+ Fair Value at Vesting of Option Awards and Stock Awards Granted in Fiscal Year That Vested During Fiscal Year | $0 | $0 | $0 | $0 | $0 |

+ Change in Fair Value as of Vesting Date of Option Awards and Stock Awards Granted in Prior Fiscal Years For Which Applicable Vesting Conditions Were Satisfied During Fiscal Year | $0 | $0 | $0 | $0 | $0 |

– Fair Value as of Prior Fiscal Year-End of Option Awards and Stock Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year | $0 | $0 | $0 | $0 | $0 |

Compensation Actually Paid | $1,150,000 | $975,000 | $937,500 | $500,000 | $1,550,000 |

Although Chart A has the necessary pieces to reconcile from the SCT value to CAP, it is challenging to interpret meaningful information about each executive’s awards.

But through the same data, the chart can be re-organized into the format below.

Chart B:

The only substantive change in numbers is that the grant date fair values (the ASC718 audited results) are isolated and the change in fair value from the grant date is categorized as “Paper Gains,” which creates a higher degree of transparency with the Summary Compensation Table.

Note the actual calculations can be more challenging with different types of grants (stock options, performance shares, RSUs), modifications, assessments of ongoing performance, overlapping monthly vesting and more. That being said, the concluding exhibits should ultimately yield strategic value.

Chart B and Why It Can Add Strategic Value

Chart B has several line items, each of which illustrate important concepts:

- Beginning/End of Year Realizable Pay – Provides how much incentive each executive currently has, along with the magnitude of retentive handcuffs. If the Realizable Pay is too little, then there could be termination risk. The opposite is true when the Realizable Pay is high.

- Value of Vested Awards During Year (Realized Pay) – Provides the potential liquidity for each executive to ensure that their liquid income is sufficient to meet their lifestyle.

- Compensation Actually Paid – Combination of 2 distinct line items:

- Paper Gains / (Losses) for Unvested Equity – Provides the increase / (decrease) in portfolio value for all unvested equity during the year.

- Grant Date Fair Values (Reportable Pay) as disclosed in the Summary Compensation Table based upon ASC718 requirements.

The combined number will represent Compensation Actually Paid and will also appear in the new Pay Versus Performance Table as required by Item 402(v) (new Reportable Pay #2).

Although historically there have been different approaches for calculating Realizable Pay, we believe that this standardized approach provides meaningful insight.

In conclusion, while the SEC’s pay versus performance rules under Item 402(v) may initially seem like a compliance burden, they also offer an unprecedented opportunity for strategic advancement. By effectively translating Compensation Actually Paid into Realized and Realizable Pay, organizations can unlock valuable insights into executive compensation structures. These insights not only foster transparency for investors but also empower compensation committees to align executive incentives with long-term organizational performance.

At Infinite Equity, we believe that innovation in pay strategy is key to navigating these new requirements. By leveraging our expertise, companies can go beyond compliance to deliver meaningful, data-driven decisions that enhance stakeholder trust and reinforce executive alignment with shareholder value. This shift transforms regulatory compliance into a catalyst for strategic growth and operational excellence.