Total Shareholder Return (TSR) is a critical measure of corporate performance, combining stock price appreciation with the value of dividends received. Accurately incorporating dividends into TSR calculations is essential for ensuring a fair and reliable assessment of shareholder returns. The methodology used to adjust for dividends can impact TSR results, performance benchmarking, and auditability.

The Importance of Dividend Adjustments

When calculating TSR, dividends should be considered reinvested as of the ex-dividend date. However, there are two primary methods for adjusting stock prices to reflect dividend reinvestment: forward-adjusted prices and backward-adjusted prices.

- Forward-Adjusted Prices (Infinite Equity Methodology): Uses a fixed historical date—typically the start of the performance period—as the anchor point for adjustments. This method better reflects the investment reality of reinvesting dividends over time.

- Backward-Adjusted Prices (Google Finance/Yahoo Finance): Uses the most recent date as the anchor point, adjusting past stock prices downward as new dividends are paid, leading to inconsistencies in historical price data.

Forward vs. Backward Adjusting: Key Differences

| Methodology | Used By | Adjusted Close Price Based On | Impact on Prices |

| Forward-Adjusted Prices | Infinite Equity | Fixed historical date (e.g., start of performance period) | Adjusted prices are higher than actual prices, reflecting additional shares purchased from reinvested dividends. |

| Backward-Adjusted Prices | Google / Yahoo Finance | Most recent close date | Adjusted prices are lower than actual prices, reflecting past dividends not received. |

Why Forward Adjustment is Superior for TSR Calculations

- Alignment with TSR Principles: Forward adjustment follows the true concept of TSR—tracking stock price appreciation and reinvested dividends from a fixed, known starting point, ensuring a more accurate measure of shareholder value creation.

- Auditability & Consistency: Unlike backward-adjusted prices, which continuously shift historical prices with new dividends, forward-adjusted prices provide a stable dataset that enhances transparency, regulatory compliance, and auditability.

- More Accurate Performance Measurement: In relative TSR calculations, using a consistent methodology ensures comparability across performance periods and eliminates distortions caused by fluctuating historical data.

- Regulatory and Compliance Advantages: Forward-adjusted TSR calculations better align with industry best practices and reduce risks associated with incorrect performance reporting.

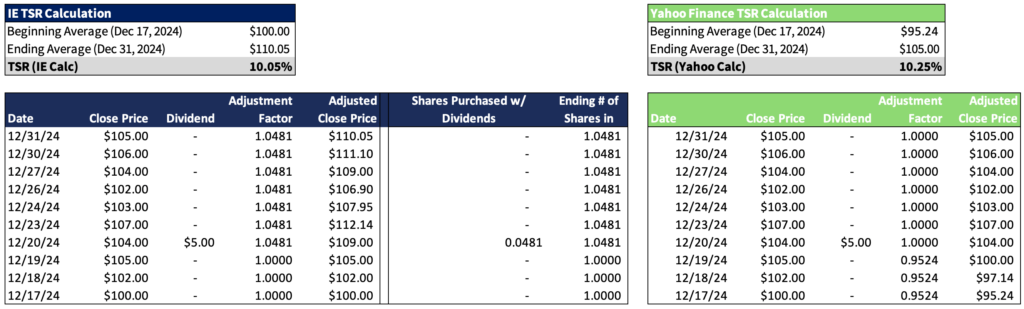

Example: Forward vs. Backward Adjusting in Action

- In the forward-adjusted model, an investor starts with one share on the performance period start date and reinvests dividends by purchasing fractional shares at the ex-dividend price. The adjusted price increases to reflect the total value of reinvested dividends, ensuring an accurate depiction of investment growth.

- In the backward-adjusted model, past prices are retroactively reduced using an adjustment factor (1.0 – [Dividend / Prior Day Closing Price]), leading to a constantly shifting dataset and making historical performance evaluation difficult.

Key Takeaways for TSR Calculations

- What is Total Shareholder Return (TSR)? TSR is a key performance metric that includes stock price appreciation and dividends.

- Why are dividend adjustments critical? Properly incorporating dividends ensures fair performance assessments.

- Forward vs. Backward Adjustments: Infinite Equity’s forward-adjustment method provides stable, audit-ready data, while backward adjustments create inconsistencies.

- Best practices in TSR calculations: Companies should adopt forward-adjusted methodologies to enhance transparency, compliance, and comparability.

Conclusion: The Infinite Equity Advantage

While both adjustment methods yield similar TSR percentages, Infinite Equity’s forward-adjustment methodology ensures greater accuracy, consistency, and auditability—key factors for reliable TSR calculations in equity incentive plans. Companies seeking accurate performance measurement should prioritize forward-adjusted methodologies for better investment insights and strategic decision-making.

Take Action: Optimize Your TSR Calculations Today

Are your TSR calculations audit-ready and optimized for long-term performance assessments? Infinite Equity specializes in forward-adjusted TSR methodologies, ensuring compliance, accuracy, and transparency in your performance metrics.

Contact Infinite Equity today to learn how our expertise can enhance your TSR calculations and improve your shareholder return analysis.

The New Rules of Pay Versus Performance