Equity is More Than Compensation—It’s a Legacy

Family-owned, start ups, and founder-led businesses face unique challenges when structuring equity plans. Whether you’re preparing for succession, considering a partial sale, or simply looking to retain key talent, Infinite Equity specializes in designing equity solutions that support long-term stability and growth.

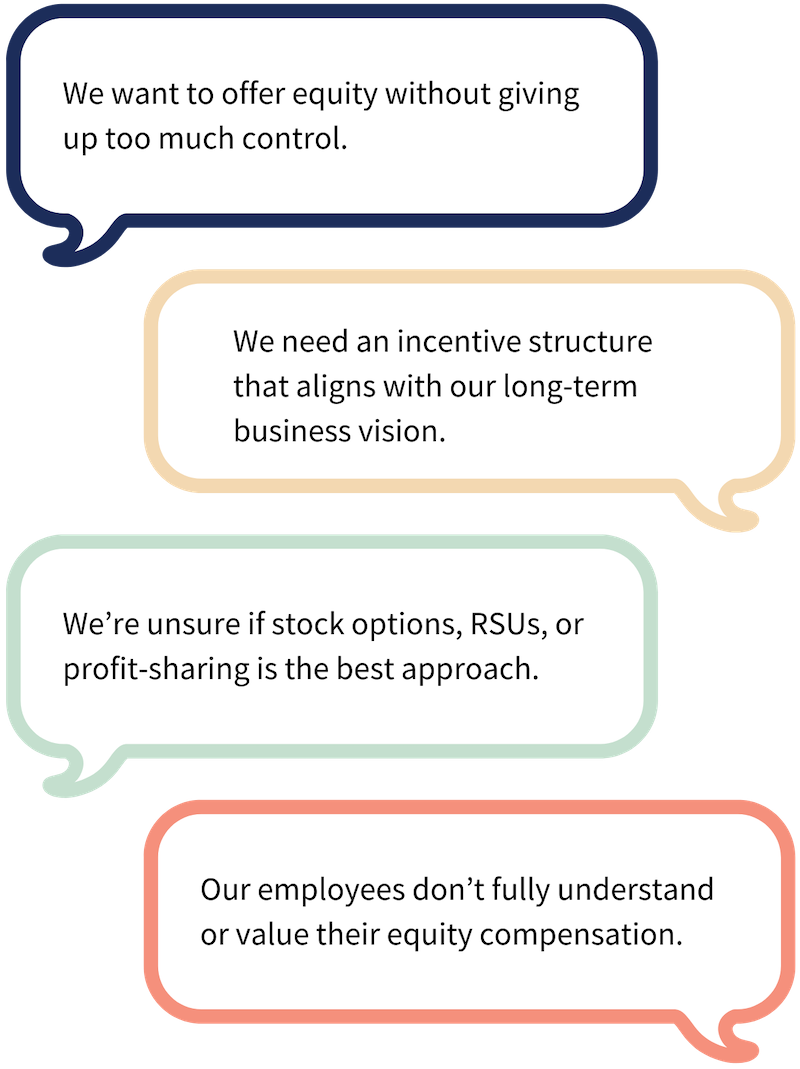

Does This Sound Familiar?

We Can Help.

Whether you’re implementing equity for the first time, restructuring existing plans, or planning for succession, our tiered solutions provide tailored support.

Solutions for Founder-Led & Family-Owned Businesses

Equity strategies must evolve with your company's growth. From early-stage funding to exit planning, our tailored solutions help you manage dilution, stay competitive, and scale smarter.

For businesses looking to implement equity incentives while maintaining control.

✔ Ownership & Control Strategy – Structuring equity to preserve leadership control.

✔ Market Benchmarking – Designing competitive but sustainable incentive programs.

✔ Custom Equity Plan Development – Stock options, RSUs, profit-sharing, or phantom equity.

Why Partner With Infinite Equity?

From venture-backed startups to family-owned businesses, our expertise adapts to meet your unique needs.

- Founder-Focused Solutions – Protect control while incentivizing key talent.

- Sustainable Growth Strategies – Ensure long-term business success.

- Expert Guidance – Decades of experience in private and family-owned business equity.

Ready to Strengthen Your Equity Strategy?

Equity Strategies for Family-Owned, Founder-Led & Start-up Companies

Equity Benchmarking – Why It Matters, and What Position is Best for You

Let’s take a closer look at why benchmarking matters, some of the most common benchmarking positions, and how to think about benchmarking for your own organization.