After the Great Financial Crisis in 2008, interest rates were held near 0% for over a decade. In the summer of 2022, interest rates began to rise in a material way. While interest rates are one of the key drivers of financial markets, how much do they impact the valuation of equity awards? In this article, we’ll explore how interest rates impact the valuation of stock options (calls), PSUs (based on relative total shareholder return), and RSUs.

Stock Options

The Black-Scholes model (BSM) is the most commonly used method for valuing stock options. The inputs into the BSM are: stock price, strike price, expected volatility, time until expiration, dividend yield, and risk-free rate. While expected volatility is generally considered one of the main drivers of the fair value from the BSM, interest rates can have a material impact as well.

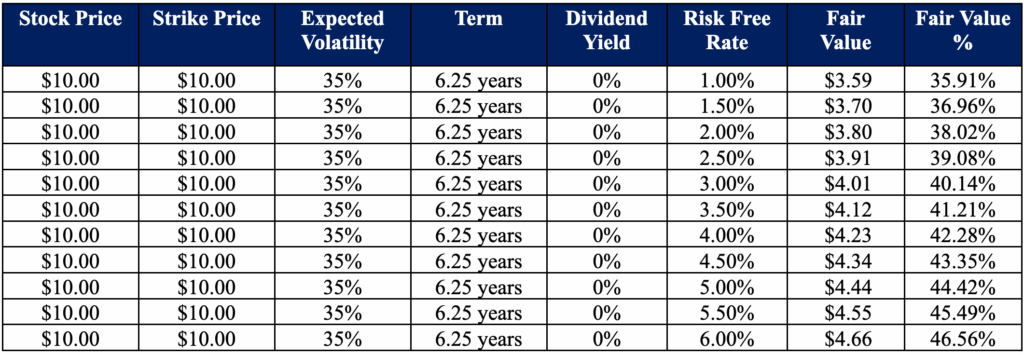

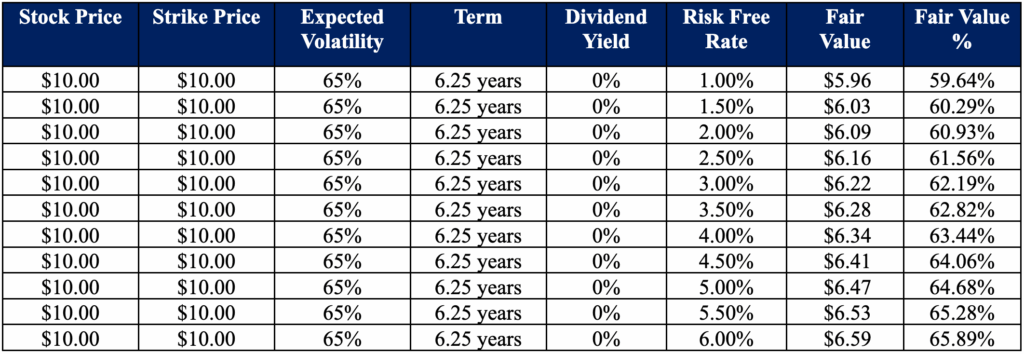

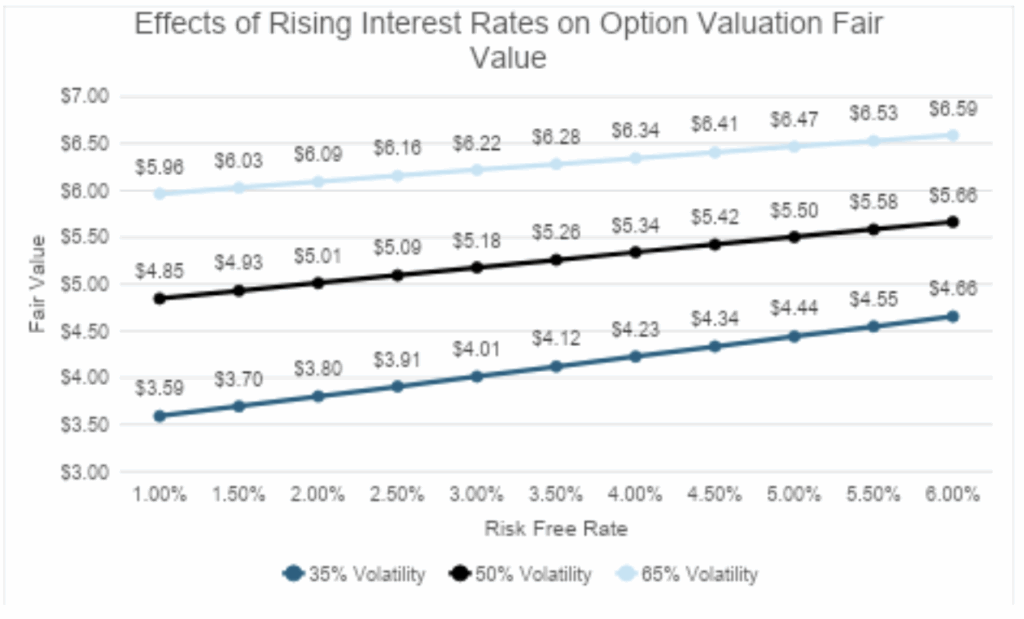

The following chart shows the change in fair value of a call option with stock price, expected volatility, term, and dividend yield held constant, with risk-free rate increasing by intervals of 0.50%, starting at 1.00%.

As can be seen, the fair value of a call option increases as interest rates rise, holding all else constant.

To get more granular, how does a rise in interest rates impact fair value for changes in expected volatility? When expected volatility is 35%, we see that fair value increases by 10.65% as interest rates rise from 1% to 6%. When expected volatility increases to 65%, however, we see that fair value increases only by 8.18% as interest rates rise from 1% to 6%. So, as expected volatility increases, the change in fair value due to rising interest rates is diminished (vice versa when expected volatility decreases).

PSUs based on Relative Total Shareholder Return

Performance Stock Units (PSUs) based on Relative Total Shareholder Return (rTSR) are typically valued using a Monte Carlo simulation, with the assumption that stock prices follow geometric Brownian motion within a risk-neutral framework. Within this framework, stock prices are expected to increase at the risk-free rate, over a large number of simulations. Also, any future value is assumed to be discounted back to the present using the same risk-free rate at which the stock price increased. Thus, when it comes to the valuation of rTSR PSUs, there is no impact from rising (or decreasing) interest rates.

RSUs

Restricted Stock Units (RSUs) are granted either with or without dividend equivalents for the award recipient. For RSUs that include dividend equivalents, the valuation is simply the stock price on the grant date, without consideration for interest rates. For RSUs that do not include dividend equivalents, the valuation is the stock price on the grant date minus the present value of expected future dividends over the requisite service period. In turn, as interest rates rise, the value of RSUs without dividend equivalents decreases, holding all else constant.

Conclusion

Rising interest rates influence different types of equity awards in distinct ways, boosting the value of stock options, leaving rTSR-based PSUs largely unchanged, and reducing the value of RSUs without dividend equivalents. For companies, understanding these nuances is critical to ensuring accurate valuations, effective plan design, and clear communication with participants.At Infinite Equity, our team of experts helps organizations navigate these complexities with precision and confidence. Whether you need support in valuation, financial reporting, or designing equity programs that withstand changing market conditions, we’re here to guide you. Reach out to Infinite Equity to learn how we can help you optimize your equity compensation strategy in today’s evolving interest rate environment.

SEC Expands Insider Trading Reporting Requirements to Foreign Private Issuers

The New Rules of Pay Versus Performance