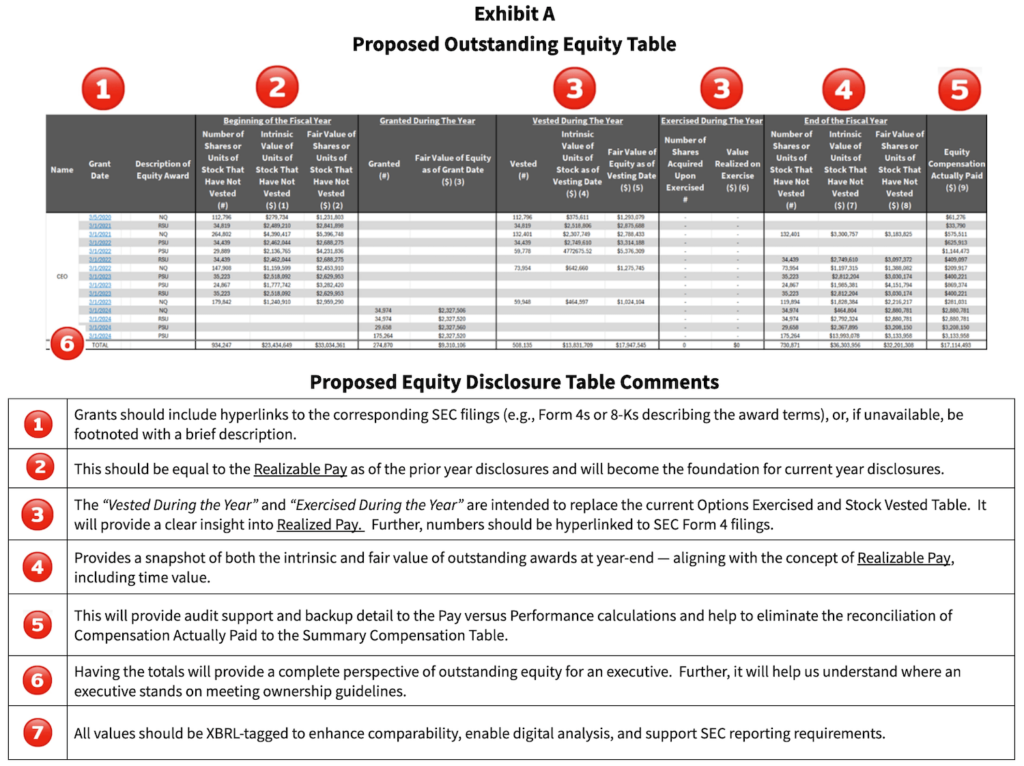

In the second installment of Infinite Equity’s Five Practical Improvements for Modernizing Executive Compensation Disclosure, we recommend streamlining three important and useful tables to get a better overview of compensation. The three independent tables in consideration are — the Outstanding Equity Awards at Fiscal Year-End Table, the Options Exercised and Stock Vested Table, and the new Pay versus Performance Table Disclosure. Independently, these create confusion and redundancy. This proposed table should be a one-stop shop for stakeholders so they can alleviate the hassle of going through multiple filings and disclosures related to executive pay.

We consolidate a few key elements of these disjointed tables that provide an improved view of equity awards from grant to vesting and exercise — for example, showing the full lifecycle of a performance share grant from award through settlement — while aligning directly with the Pay versus Performance framework. We argue that this approach enhances clarity, reduces redundancy, and offers a investor-friendly understanding of the relationship between executive pay and performance.

Aside from Investor transparency and valuation accuracy, the overall purpose of these tables can be summarized as:

“Outstanding Equity Table”: A snapshot of the equity-based compensation awards that remain outstanding and unexercised at the end of the fiscal year — and which still have the potential to deliver future value to named executive officers (NEOs), commonly referred to as Realizable Pay — to named executive officers (NEOs).

“Options Exercised and Stock Vested Table”: Designed to show the realized value of equity compensation during the fiscal year — in other words, how much the executive actually monetized or took home from stock-based awards in that year, or Realized Pay.

“Pay versus Performance Table Disclosure”: Creates a new definition of pay called Compensation Actually Paid which represents a composite of both Realizable and Realized Pay. Under the Pay versus Performance rules, equity compensation is marked to market over the life of the award and is considered compensation actually paid up to the point of vesting — at which point ownership transfers to the executive. Any appreciation post-vesting is treated as an investment return rather than compensation.

As compensation structures become more performance-based and long-term oriented, the disclosure framework should evolve too. We believe this reimagined equity table would provide a clearer, more aligned, and more useful lens on executive compensation.

It’s time to move beyond legacy disclosure checkboxes — and build a model that better reflects modern equity compensation practices and investor expectations.

For more information on Infinite Equity’s suggested amendments to the current executive compensation disclosure landscape, refer to the rest of our materials on our website, www.InfiniteEquity.com