Infinite Equity laid out the preferred method for calculating Total Shareholder Return (TSR) here. However, the calculation of TSR ultimately must follow the definition outlined in the legal grant agreement. Some companies do not assume that dividends are reinvested in the underlying entity when they are issued; instead, the dividends are essentially treated as a pool of cash separate from the investment in the stock. We call this approach to calculating TSR “dividend accumulation”, in contrast to the best practice of “dividend reinvestment”.

Common Approach when Accumulating Dividends

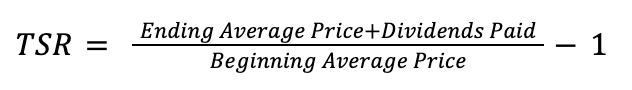

The most common approach to calculating TSR when accumulating dividends is use the formula below:

Where:

- Ending Average Price is the average closing stock price (i.e., not adjusted for dividends) of the entity over a period of time at the end of the performance period

- Beginning Average Price is the average closing stock price (i.e., not adjusted for dividends) of the entity over a period of time at the start of the performance period

- Dividends Paid is the total number of dividends paid over the performance period[1] (including the beginning average period)

The table below shows the stock price of an example company during a sample beginning and ending average period. We will assume that the company also distributed \$14.60 in dividends over the performance period inclusive of the beginning average (i.e., from 12/3/2015 to 12/31/2018).

| Beginning of Performance Period | End of Performance Period | |||||

|---|---|---|---|---|---|---|

| Day Number | Date | Price | Dividend | Date | Price | Dividend |

| 1 | December 31, 2015 | $132.04 | $0.00 | December 31, 2018 | $204.18 | $0.00 |

| 2 | December 30, 2015 | $133.26 | $0.00 | December 28, 2018 | $202.08 | $0.00 |

| 3 | December 29, 2015 | $134.14 | $0.00 | December 27, 2018 | $200.12 | $0.00 |

| 4 | December 28, 2015 | $133.12 | $0.00 | December 26, 2018 | $197.57 | $0.00 |

| 5 | December 24, 2015 | $133.89 | $0.00 | December 24, 2018 | $187.76 | $0.00 |

| 6 | December 23, 2015 | $134.15 | $0.00 | December 21, 2018 | $192.10 | $0.00 |

| 7 | December 22, 2015 | $133.14 | $0.00 | December 20, 2018 | $193.58 | $0.00 |

| 8 | December 21, 2015 | $131.19 | $0.00 | December 19, 2018 | $195.17 | $0.00 |

| 9 | December 18, 2015 | $129.53 | $0.00 | December 18, 2018 | $196.52 | $0.00 |

| 10 | December 17, 2015 | $133.97 | $1.00 | December 17, 2018 | $197.92 | $0.00 |

| 11 | December 16, 2015 | $135.88 | $0.00 | December 14, 2018 | $200.00 | $2.20 |

| 12 | December 15, 2015 | $134.88 | $0.00 | December 13, 2018 | $202.42 | $0.00 |

| 13 | December 14, 2015 | $132.02 | $0.00 | December 12, 2018 | $202.48 | $0.00 |

| 14 | December 11, 2015 | $130.31 | $0.00 | December 11, 2018 | $202.28 | $0.00 |

| 15 | December 10, 2015 | $131.71 | $0.00 | December 10, 2018 | $203.26 | $0.00 |

| 16 | December 9, 2015 | $131.71 | $0.00 | December 7, 2018 | $204.88 | $0.00 |

| 17 | December 8, 2015 | $133.36 | $0.00 | December 6, 2018 | $207.96 | $0.00 |

| 18 | December 7, 2015 | $135.60 | $0.00 | December 4, 2018 | $210.12 | $0.00 |

| 19 | December 4, 2015 | $136.48 | $0.00 | December 3, 2018 | $220.81 | $0.00 |

| 20 | December 3, 2015 | $132.66 | $0.00 | November 30, 2018 | $218.24 | $0.00 |

| 20-Trading Day Average | $133.15 | $201.97 | ||||

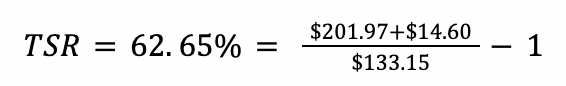

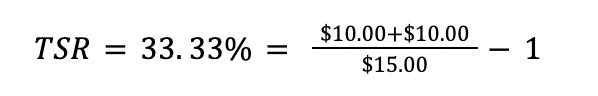

TSR would be calculated as follows:

However, this approach for calculating TSR artificially inflates the TSR for companies that pay a dividend during the beginning average period. In this case, the beginning average price of \$133.15 in the denominator reflects prices both before the \$1.00 dividend distributed on 12/17/2015 and after that dividend. The closing prices after 12/17/2015 are lower (because they no longer carry the right to receive the dividend), which lowers the beginning average value. The numerator includes the full value of the \$1.00 dividend, while the denominator is also lowered by the dividend, which leads to an artificially high TSR.

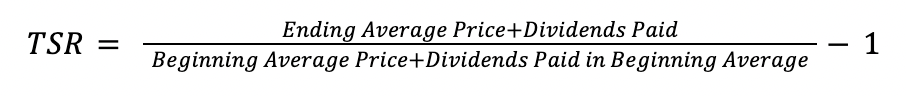

An alternate approach also exists in the marketplace to address the bias above. The alternate approach sets the beginning average equal to the average closing stock price over the beginning average plus any dividends paid during the beginning average period, as shown below:

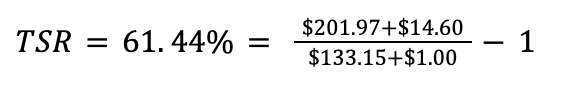

However, this approach over-corrects for the original problem. Now the entire dividend paid during the beginning average period is added to the denominator, when really the dividend only impacted a portion of the closing stock prices within that range. TSR under the alternate approach would be calculated as follows:

Although the impact appears small in the examples above, the effects can be significant if companies pay large dividends (e.g., special dividend upon a spin-off) during the beginning average period.

Illustrative Example

In order to further illustrate the bias generated by the existing approaches for calculating TSR when accumulating dividends, let’s examine a simple but more extreme example. Company X is trying to measure TSR over the 3-year period from 1/1/2016 to 12/31/2018, using 20-trading day average periods prior to the start and end of the period. Company X’s stock price is \$20 on December 3, 2015 and has 0% volatility (i.e., stock price does not fluctuate due to market activity). On 12/17/2015 (halfway through the beginning average period), Company X spins off half their business. Shareholders receive a \$10 special cash dividend and the Company X’s stock price drops to \$10. Company X’s stock price remains at \$10 until 12/31/2018.

First, we should note that the TSR over the 3-year period should be 0%. A shareholder on 12/3/2015 held \$20 of value on every day throughout the performance period, whether it was in the form of a \$20 share of Company X’s stock (which was the case from 12/3/2015 to 12/16/2015) or in the form of a \$10 share of Company X’s stock and \$10 in cash (which was the case from 12/17/2015 to 12/31/2018). Now let’s examine the biases of the existing approaches for calculating TSR.

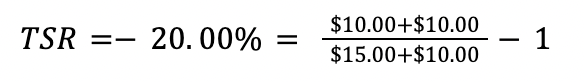

The most common approach would look only at the raw closing prices during the beginning and ending average periods and the total dividends paid, according to the formula below:

The ending average is \$10, the total dividends paid is \$10, and the beginning average is \$15 (since the stock price was \$20 for half the beginning average period and \$10 for the other half). We can see how egregiously wrong the TSR for Company X is in this case.

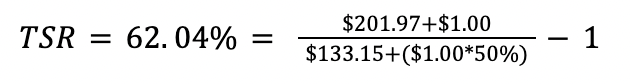

Under the alternate approach, the dividend would be added back to the denominator in an attempt to address the bias above. However, the result is simply a bias in the other direction. TSR under the alternate approach would follow the formula below:

Again, we see a wildly inaccurate TSR.

The Best of the Worst

It is worth reiterating here that the best way to calculate TSR is to assume that dividends are reinvested in the issuing entity. However, if you truly must accumulate dividends, the best way to ensure accurate TSR is to add any dividends paid during the beginning average period to the denominator of the TSR calculation, weighted for the percentage of the beginning average period after the dividend was paid. In our simple example above, 50% of the dividend would be added to the beginning average, since the dividend payment occurred halfway through the beginning average. This approach calculates TSR correctly at 0%.

While the method described above is theoretically the best way to accumulate dividends, it also adds additional complexity to the TSR calculation, especially if the TSR calculation must be done for a large peer group (e.g., the members of the S&P 500 Index).

[1] Companies should specify what date (ex-dividend date, announcement date, payment date, etc.) is used to determine which dividends fall within the performance period. Theoretically, the ex-dividend date is the most accurate date to use, as this is the date the stock price drops to reflect the fact that the stock price now trades without the right to the next dividend.